Ramp : Automate Vendor Invoices, Approvals and Payments

Ramp: in summary

Ramp offers a dedicated accounts payable automation solution designed to help finance teams eliminate manual invoice processing, reduce approval delays, and gain complete visibility over vendor-related spend. This tool is part of Ramp’s broader finance operations platform, tailored for U.S.-based businesses with 2 to 1,000 employees across all industries.

The software centralizes all invoice workflows—from intake to payment—and embeds customizable controls directly into the approval process. With deep ERP integrations and real-time tracking, Ramp's AP module not only accelerates the payment cycle but also ensures policy compliance, audit readiness, and clean books. It’s built for finance teams looking to replace fragmented email-based approvals, manual data entry, and disjointed payment systems with a single streamlined interface.

What are the main features of Ramp?

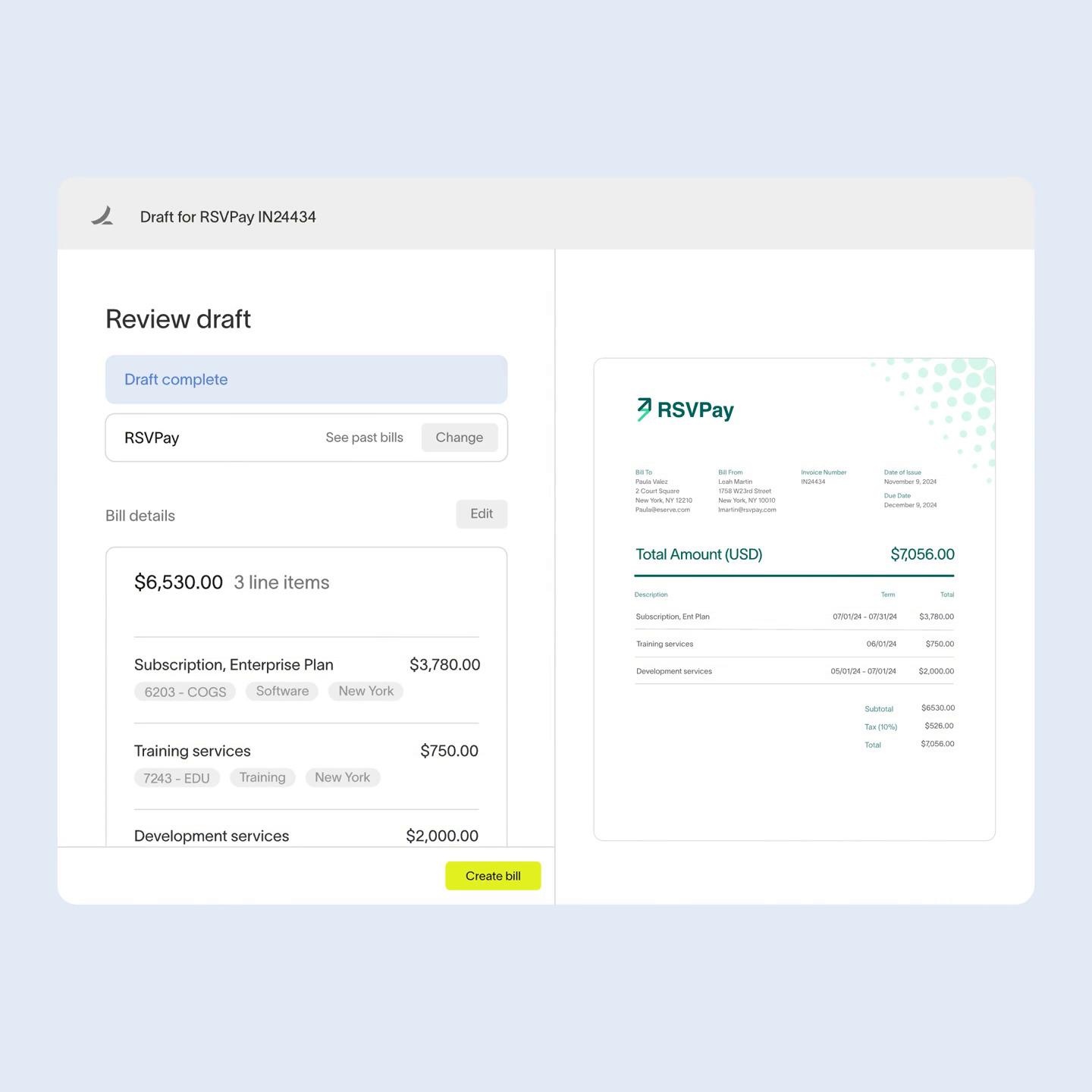

Centralized invoice intake and digitization

Ramp captures and organizes invoices across multiple channels—including email, uploads, and accounting integrations—and uses OCR technology to extract and pre-fill key fields like vendor name, amount, and due date.

- Drag-and-drop, email forwarding, or automated invoice intake

- Optical character recognition (OCR) for auto-filling invoice data

- Real-time duplicate invoice flagging and error detection

- Custom tagging and categorization for GL mapping or reporting

This ensures finance teams never lose track of invoices and can maintain full visibility over all outstanding liabilities from a single dashboard.

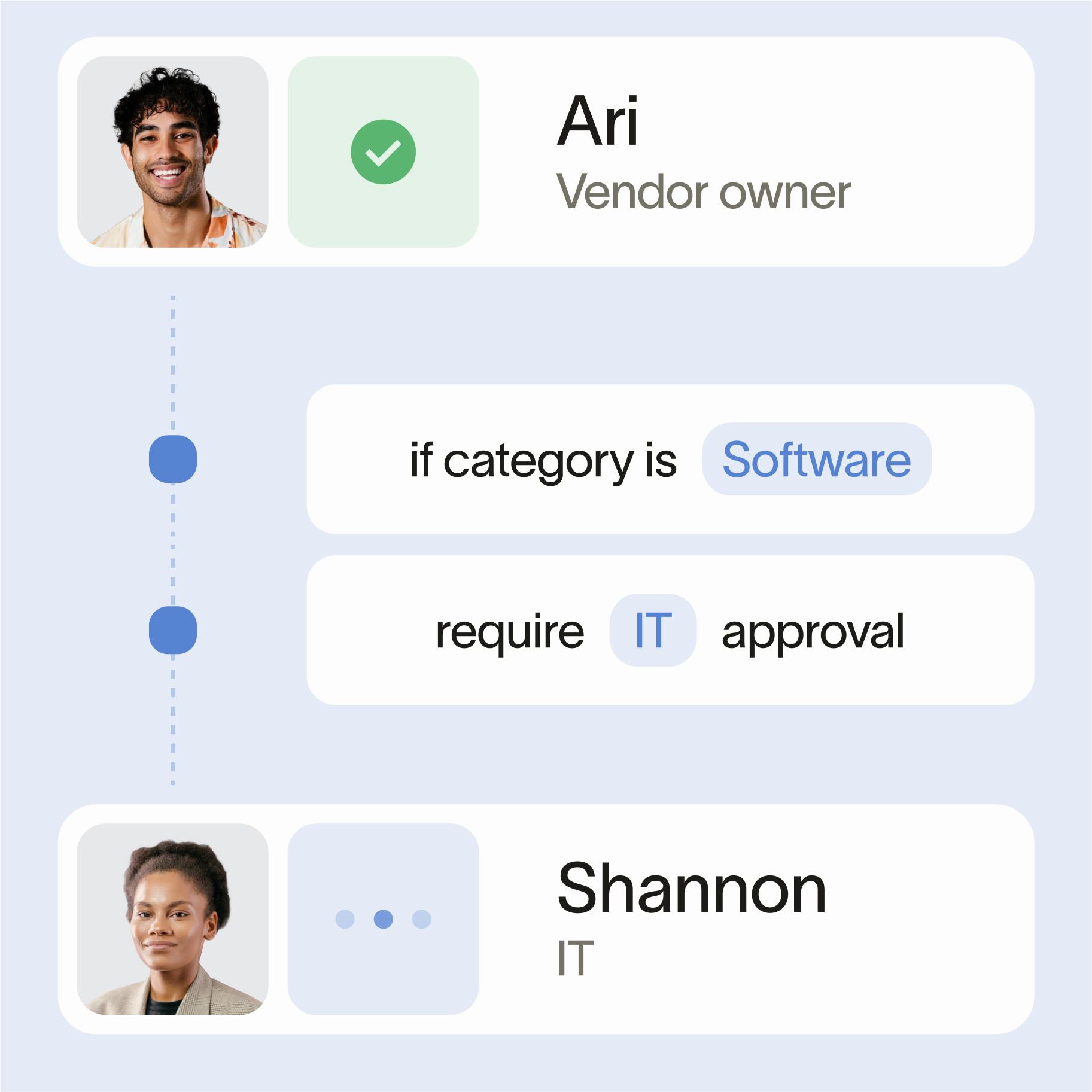

Automated approval workflows

Ramp allows companies to design structured approval chains that mirror internal policies. Workflows can be triggered based on invoice amount, department, vendor type, or budget code, helping finance teams reduce bottlenecks and ensure compliance.

- Multi-tiered approval logic based on custom rules

- Notifications via Slack, email, or mobile app

- Automated reminders and escalation paths

- Complete audit trail of all approver actions

These approval flows replace informal email threads with structured, traceable decisions that accelerate invoice processing without sacrificing governance.

Integrated invoice-to-payment execution

After approvals, Ramp allows invoices to be paid directly through the platform using ACH, check, or virtual card. Finance teams can schedule payments based on vendor terms, cash flow planning, or early payment discounts.

- Supports ACH, physical checks, and Ramp virtual cards

- Real-time sync with accounting systems upon payment

- Payment scheduling by due date or custom triggers

- One-click payment tracking and confirmation

This eliminates the need for external banking portals or disjointed AP systems and ensures accurate payment records across systems.

Purchase order matching and invoice validation

For companies using purchase orders, Ramp offers invoice matching capabilities to prevent overpayments, errors, or fraudulent billing. This supports two-way or three-way matching depending on the procurement setup.

- PO-to-invoice and receipt matching

- Validation of quantities, prices, and vendor information

- Exception handling workflows for discrepancies

- Linked documentation for audit and compliance teams

This feature helps enforce procurement controls and avoid payment mistakes before money leaves the business.

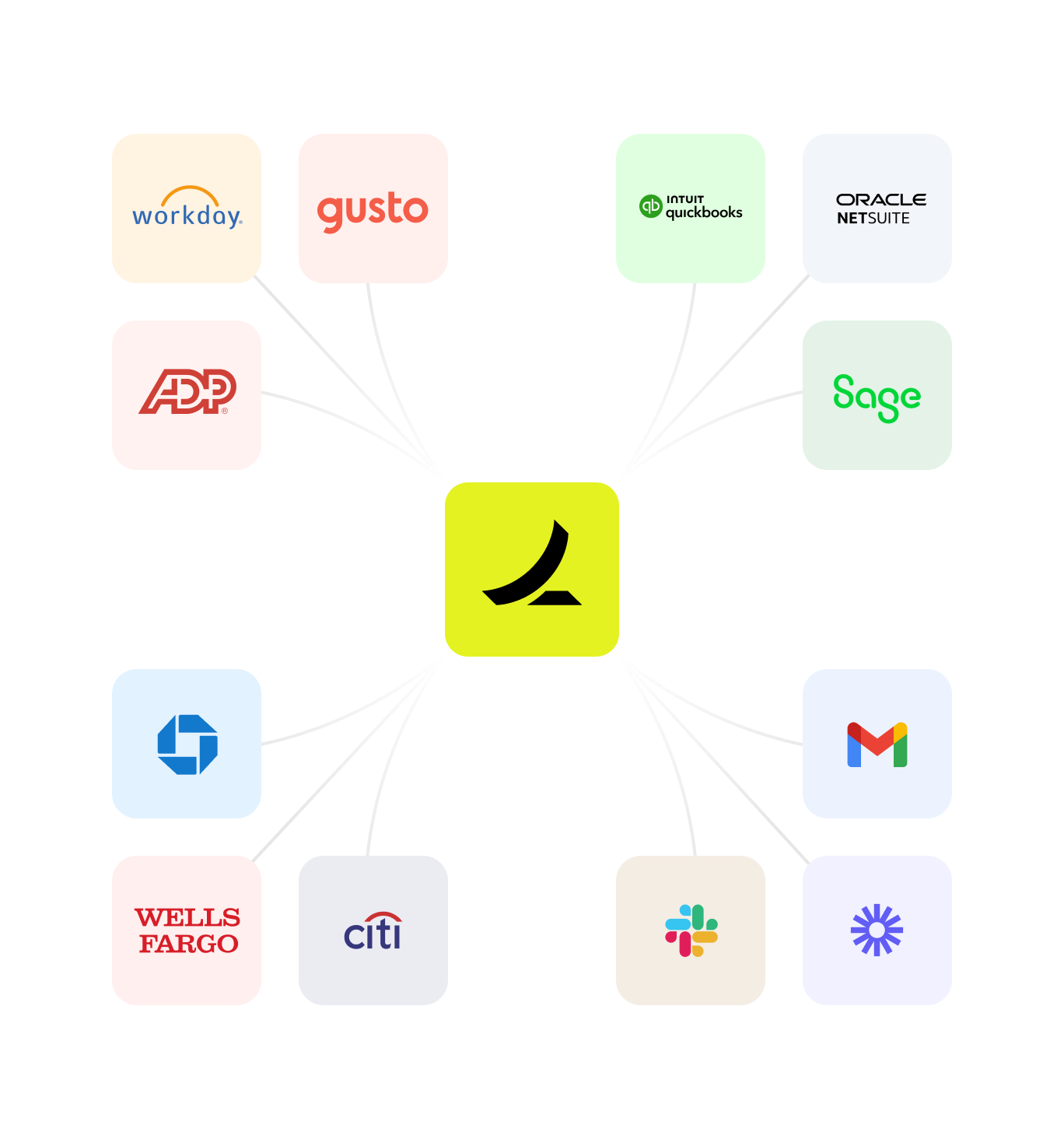

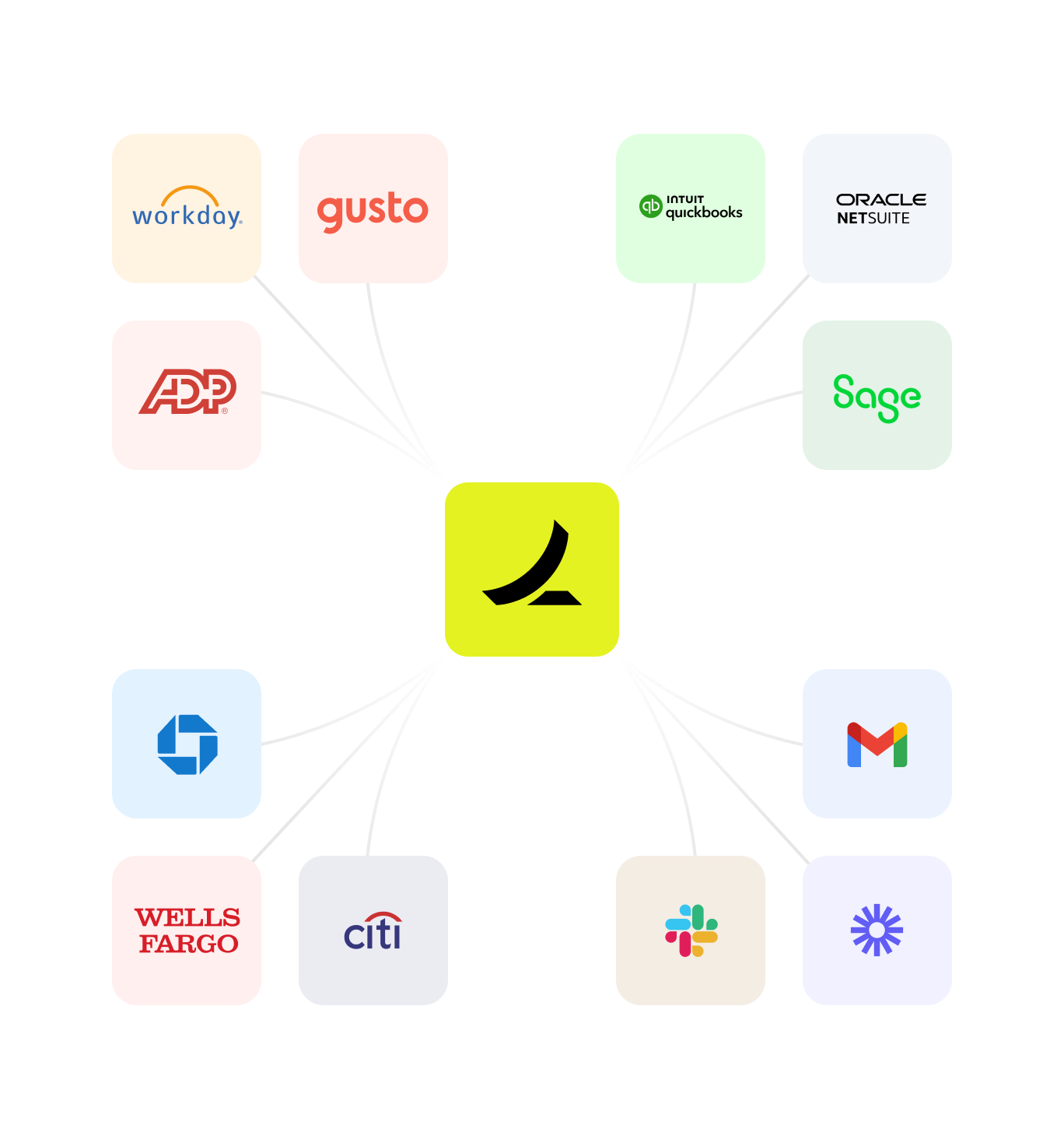

ERP integrations and accounting automation

Ramp’s AP module integrates natively with leading ERP and accounting platforms including NetSuite, QuickBooks, Xero, Microsoft Dynamics, Sage Intacct, and Workday. This ensures that invoice, payment, and approval data are continuously synced across systems.

- Bi-directional data sync for invoices, payments, and vendor info

- GL coding by class, department, or custom fields

- Auto-categorization of expenses and amortization schedules

- Close-ready exports and real-time reconciliation support

These integrations reduce the risk of manual entry errors and accelerate monthly and quarterly close cycles.

Real-time spend insights and audit readiness

Ramp provides dynamic reporting on accounts payable, allowing finance teams to monitor open liabilities, track vendor trends, and identify payment risks or cost-saving opportunities.

- Dashboards for unpaid, pending, and paid invoices

- Filtering by vendor, department, or payment status

- Cash flow forecasting based on upcoming AP

- Custom export reports for audits and leadership reviews

This visibility helps finance leaders make proactive decisions and maintain compliance with internal controls and external audits.

Why choose Ramp?

- Full automation from invoice to payment: Streamline every AP task, from intake to execution, in one platform.

- Stronger financial controls: Ramp embeds policy enforcement and approval governance into daily workflows.

- Faster payments and fewer delays: Structured approvals and auto-scheduling remove process bottlenecks.

- Audit-ready documentation: Every invoice, approval, and payment is traceable with timestamps and context.

- ERP-native architecture: Deep integrations ensure data consistency and speed up the financial close.

Its benefits

Proactive spend control

Real-time visibility

Automated workflows

Seamless ERP integration

Frictionless employee experience

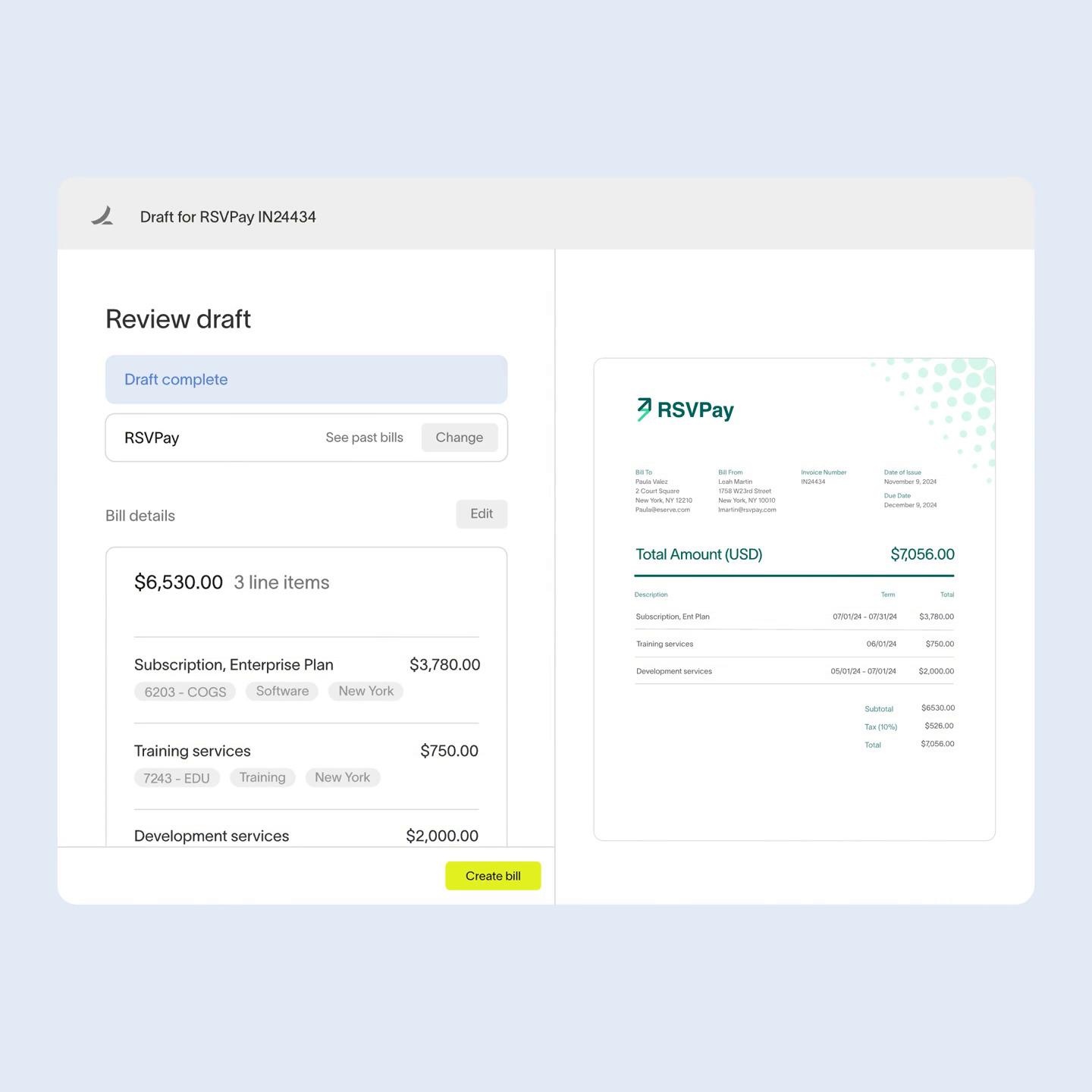

Ramp - Effortlessly process complex invoices and line items with Ramp’s OCR. Custom rules and smart suggestions code everything accurately.

Ramp - Effortlessly process complex invoices and line items with Ramp’s OCR. Custom rules and smart suggestions code everything accurately.  Ramp - Handle all vendor payments for free, on a single platform—by check, card, ACH, or domestic and international wire.

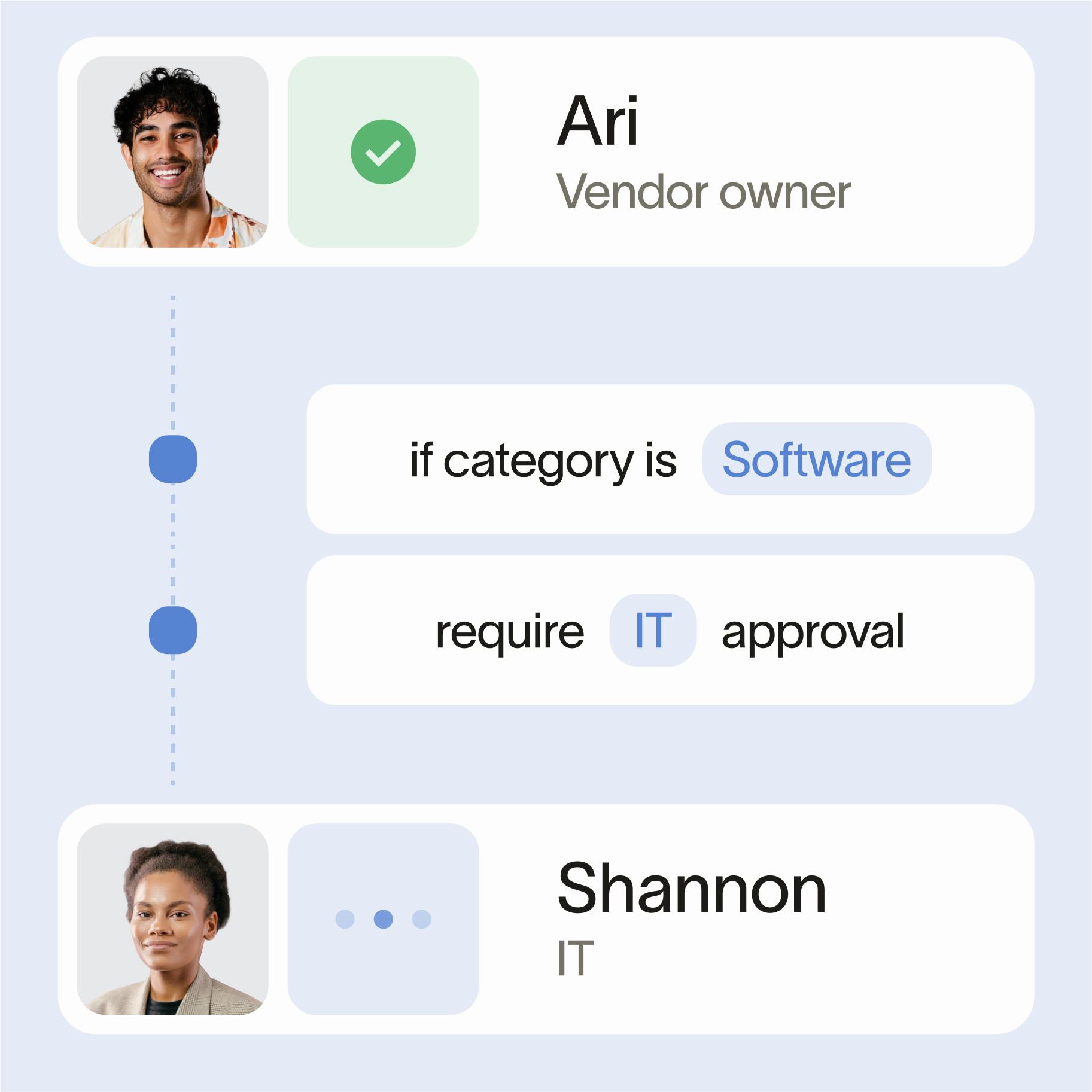

Ramp - Handle all vendor payments for free, on a single platform—by check, card, ACH, or domestic and international wire.  Ramp - Ramp automatically sends each bill to the right approvers—no manual effort needed.

Ramp - Ramp automatically sends each bill to the right approvers—no manual effort needed.  Ramp - Integrate your ERP to sync bills, vendor information, purchase orders, and more. All in real time.

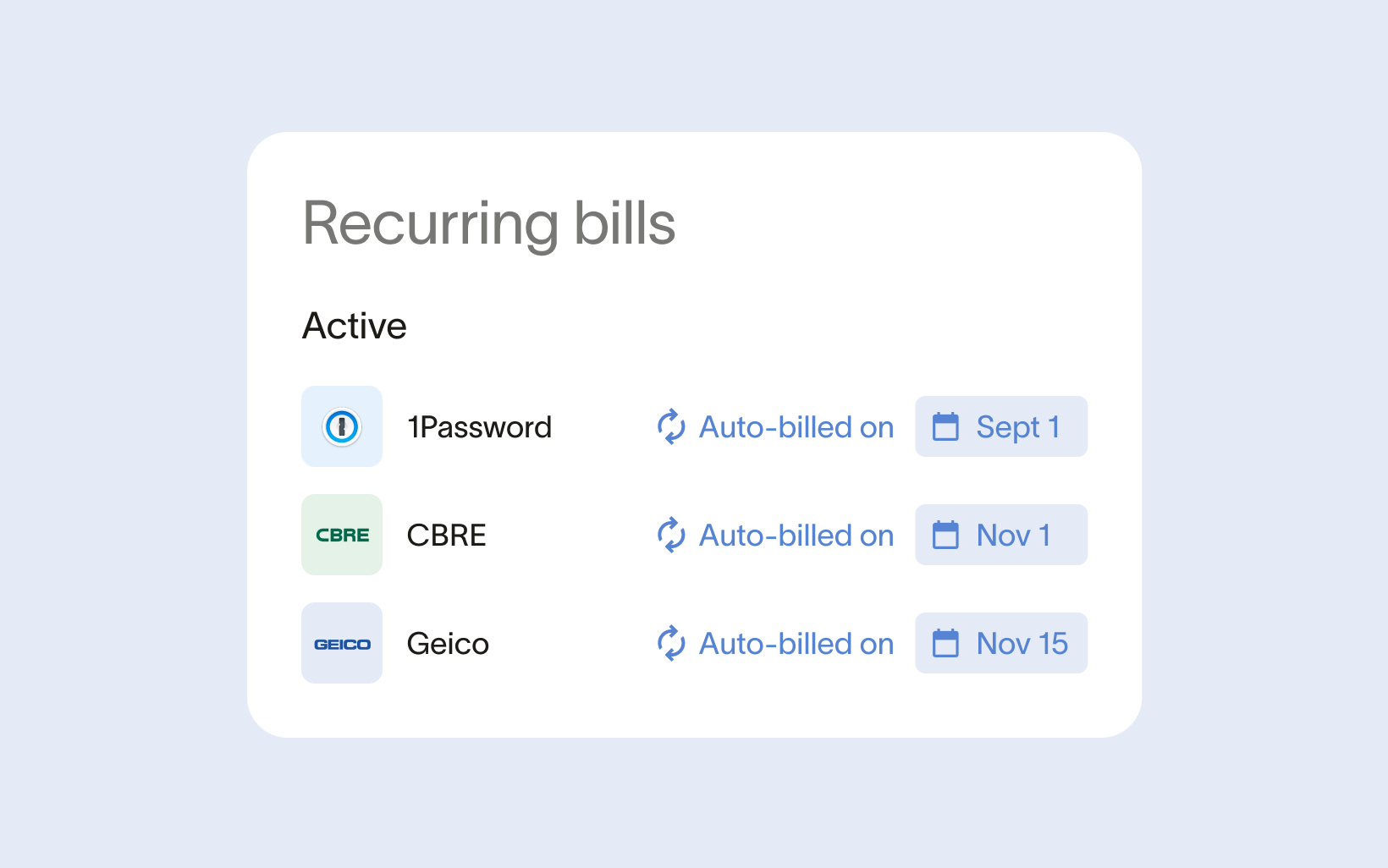

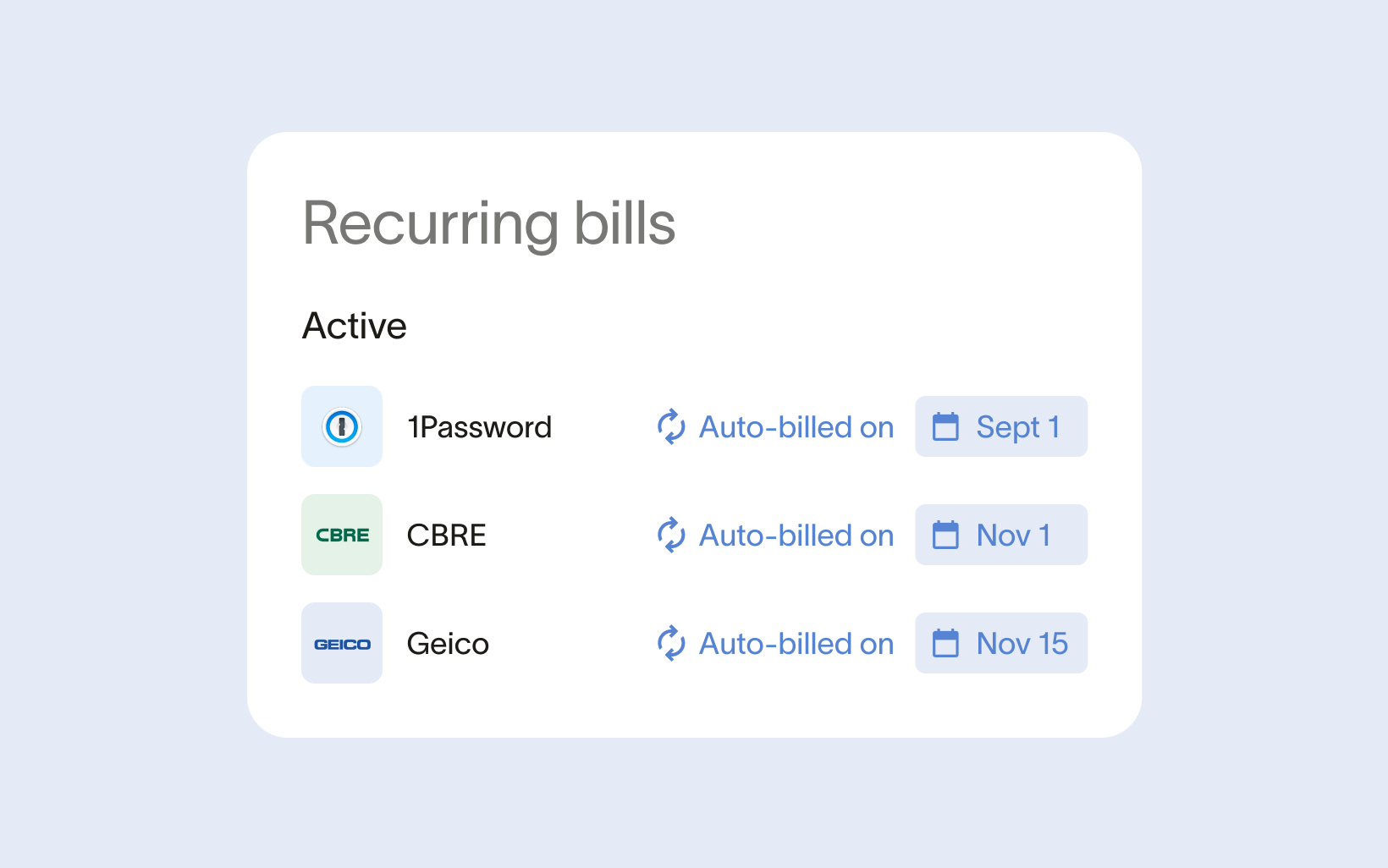

Ramp - Integrate your ERP to sync bills, vendor information, purchase orders, and more. All in real time.  Ramp - Ramp manages recurring bills, batch payments, and vendor onboarding automatically. Need to make changes yourself? Apply updates in bulk.

Ramp - Ramp manages recurring bills, batch payments, and vendor onboarding automatically. Need to make changes yourself? Apply updates in bulk.

Ramp: its rates

Free

Free

Plus

$12.00

/month /user

Enterprise

$18.00

/month /user

Clients alternatives to Ramp

Manage corporate travel effortlessly with automated booking, expense tracking, and comprehensive reporting features.

See more details See less details

Navan simplifies corporate travel management with features like automated booking tailored to company policies, real-time expense tracking, and robust reporting tools. Its user-friendly interface ensures seamless integration with existing workflows. By reducing administrative work, this tool enhances productivity and cost control.

Read our analysis about NavanBenefits of Navan

No booking fees or hidden costs

Access to exclusive travel discounts

Easy creation of travel policies across the organization

To Navan product page

Complete solution for managing business expenses: simplified entry, rapid validation, customized reports and integration with accounting tools.

See more details See less details

Kelio Expense Notes offers a complete solution for managing business expenses. With its intuitive interface, it enables simplified expense entry, while facilitating rapid validation thanks to customizable workflows. Users can generate detailed reports tailored to their specific needs. What's more, it integrates easily with various accounting tools, ensuring consistent and efficient expense management across the enterprise.

Read our analysis about Kelio Notes de fraisTo Kelio Notes de frais product page

Streamline your payment process with this payment gateway software. Accept multiple payment types and currencies securely and efficiently.

See more details See less details

With this software, you can easily integrate with your website or app and offer a seamless checkout experience to your customers. Its fraud prevention tools and PCI compliance ensure secure transactions, while its reporting and analytics features allow you to track and optimize your payment performance.

Read our analysis about WallesterBenefits of Wallester

300 virtual cards for FREE

Comprehensive compliance with regulations.

Versatile card tokenization for digital wallets.

To Wallester product page

Appvizer Community Reviews (0) The reviews left on Appvizer are verified by our team to ensure the authenticity of their submitters.

Write a review No reviews, be the first to submit yours.