Nordigen : Account Information API

Nordigen: in summary

Nordigen is a Transaction data API (Open Banking) platform with a suite of products that helps companies in building financial applications which can interact with bank accounts and automatically gain insights to add value to the data. With just one API call you can identify basic identity information or get a detailed income overview for that person, including data points like projected income and income stability. Our platform helps banks, lenders and fintechs to develop apps that easily sync with customers bank account data, speed up the customers onboarding process, verify your customer identity, use cleansed data from bank statements to make informed decisions.

Our clients are Banks, Lenders, Fintechs and companies from other industries who use Nordigen to make improvements in risk assessment of borrowers, check the amount of income, verify identity, improve customer onboarding and different other use cases. One of our clients is BigBank, who is a lender in several European countries, with Nordigen has improved their bank statement analysis speed one hundred times. By using Nordigen API, other companies have successfully increased their lending volumes, increased loan acceptance rates, overall efficiency and revenue.

A short summary of features:

- Transaction Categorisation

- Calculate income stability, regularity and trend.

- Depicting tendencies and estimations of overall liabilities

- Calculate the probability of a customer to default on a loan, based on patterns identified in the transaction data.

- Generate data points that are associated with high-risk behaviour, using bank account data.

- KYC

- Account Aggregation

Its benefits

Free

Easy to integrate

Full European coverage

ISO 27001

Nordigen - PSD2 API data points

Nordigen - PSD2 API data points  Nordigen - 90 day account connection

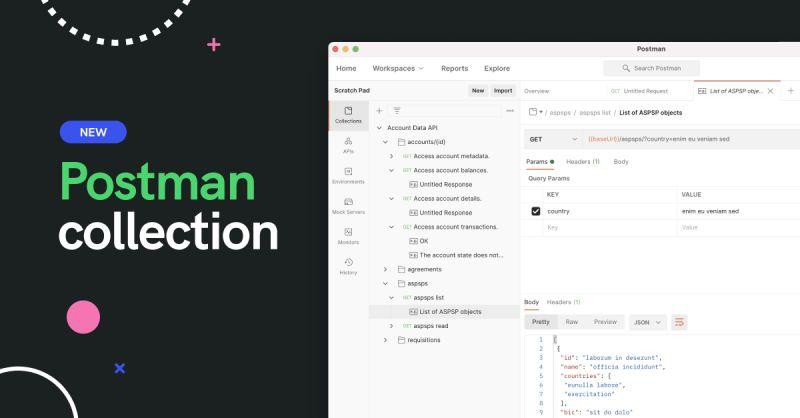

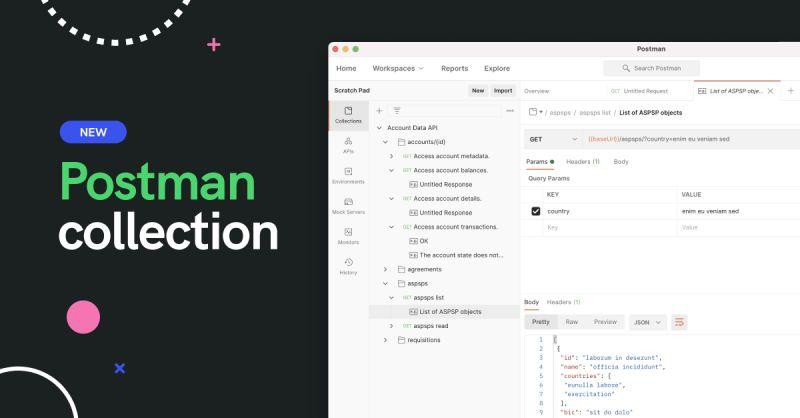

Nordigen - 90 day account connection  Nordigen - Postman collection

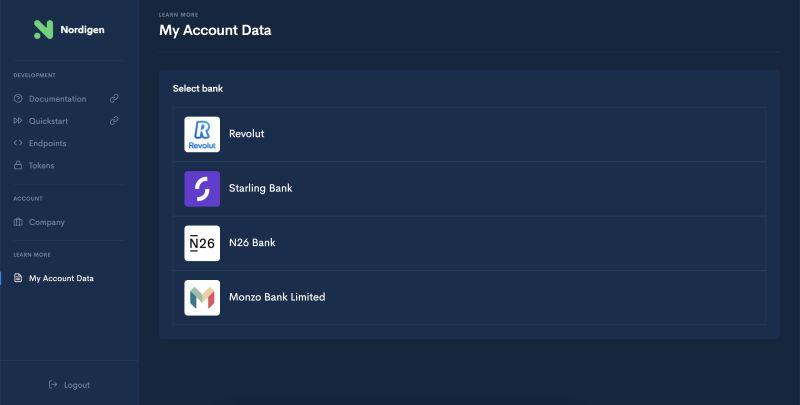

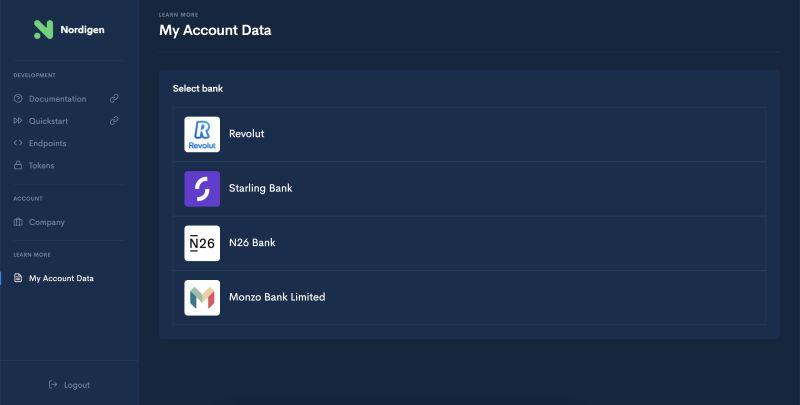

Nordigen - Postman collection  Nordigen - Neobanks and traditional banks supported

Nordigen - Neobanks and traditional banks supported

Nordigen: its rates

Free

Free

Premium

Rate

On demand

Clients alternatives to Nordigen

Streamline treasury management with advanced automation and reporting features.

See more details See less details

Fygr's treasury management system simplifies financial operations by automating tasks such as cash positioning, forecasting, and risk management. Its robust reporting capabilities provide real-time visibility into cash flows and liquidity, enabling better decision-making.

Read our analysis about Fygr

Automate billing and invoicing with ease. Streamline your financial tasks and get paid faster.

See more details See less details

With our software, you can easily set up recurring billing, track expenses, and send professional invoices. Get paid faster with automated payment reminders and online payment options. Plus, our reporting tools give you valuable insights into your financial performance.

Read our analysis about FinomBenefits of Finom

Fast opening a business account

Up to 3% cashback on every transaction

Up to 10 000€ ATM withdrawal limit per card

Streamline financial services with this software. Manage transactions, automate workflows, and increase efficiency.

See more details See less details

This banking and financial software offers a range of features to improve your financial services. With the ability to manage transactions, automate workflows, and increase efficiency, this software streamlines your financial processes. Whether you're a bank or financial institution, this software is designed to help you meet your needs.

Read our analysis about Particeep Appvizer Community Reviews (0) The reviews left on Appvizer are verified by our team to ensure the authenticity of their submitters.

Write a review No reviews, be the first to submit yours.