VisionCredit Fintech : Streamlined Credit Solutions for Fintech Enthusiasts

VisionCredit Fintech: in summary

VisionCredit Fintech targets professionals in the financial sector seeking cutting-edge solutions to credit management. With features like AI-driven credit scoring, instant loan processing, and comprehensive analytics, this software stands out as a leader in fintech innovation.

What are the main features of VisionCredit Fintech?

AI-Driven Credit Scoring

Enhance your financial assessments with VisionCredit Fintech’s AI-driven credit scoring. This feature utilizes advanced machine learning algorithms to provide accurate and dynamic credit scores, offering deeper insights and faster decision-making. Enjoy benefits such as:

- Real-time credit insights

- Adaptive credit models

- Improved lending accuracy

Instant Loan Processing

Accelerate your financial services with instant loan processing, designed to expedite borrower-lender interactions. VisionCredit Fintech automates and simplifies the loan approval workflow, ensuring timely responses and satisfied clients. Key advantages include:

- Automated loan assessments

- Seamless application processing

- Quick funding disbursement

Comprehensive Analytics

Stay ahead by leveraging comprehensive analytics tools that transform data into actionable insights. VisionCredit Fintech provides detailed reporting and performance metrics to assist in strategic planning and optimizing financial operations. Features include:

- In-depth financial reporting

- Customizable dashboards

- Predictive analytics capabilities

Its benefits

GDPR

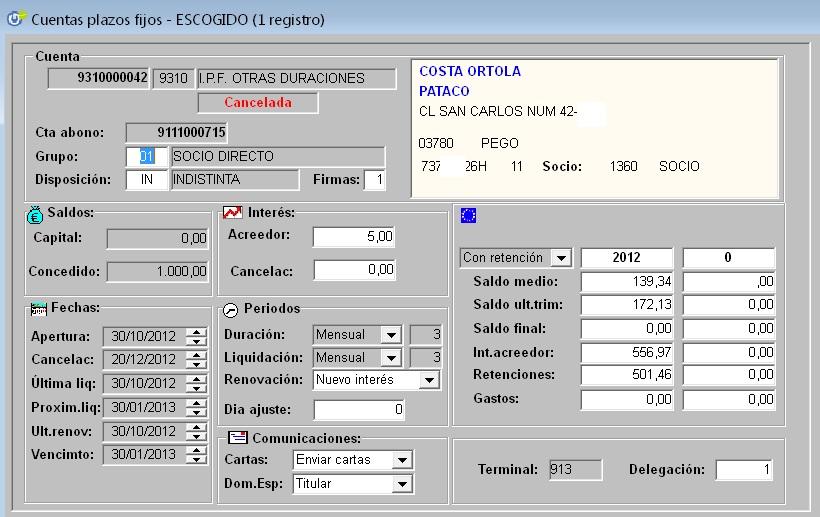

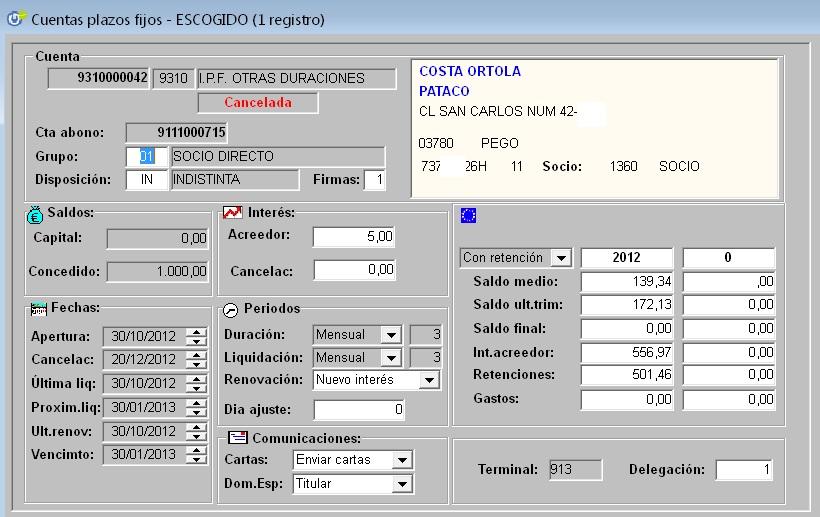

VisionCredit Fintech - Screenshot 1

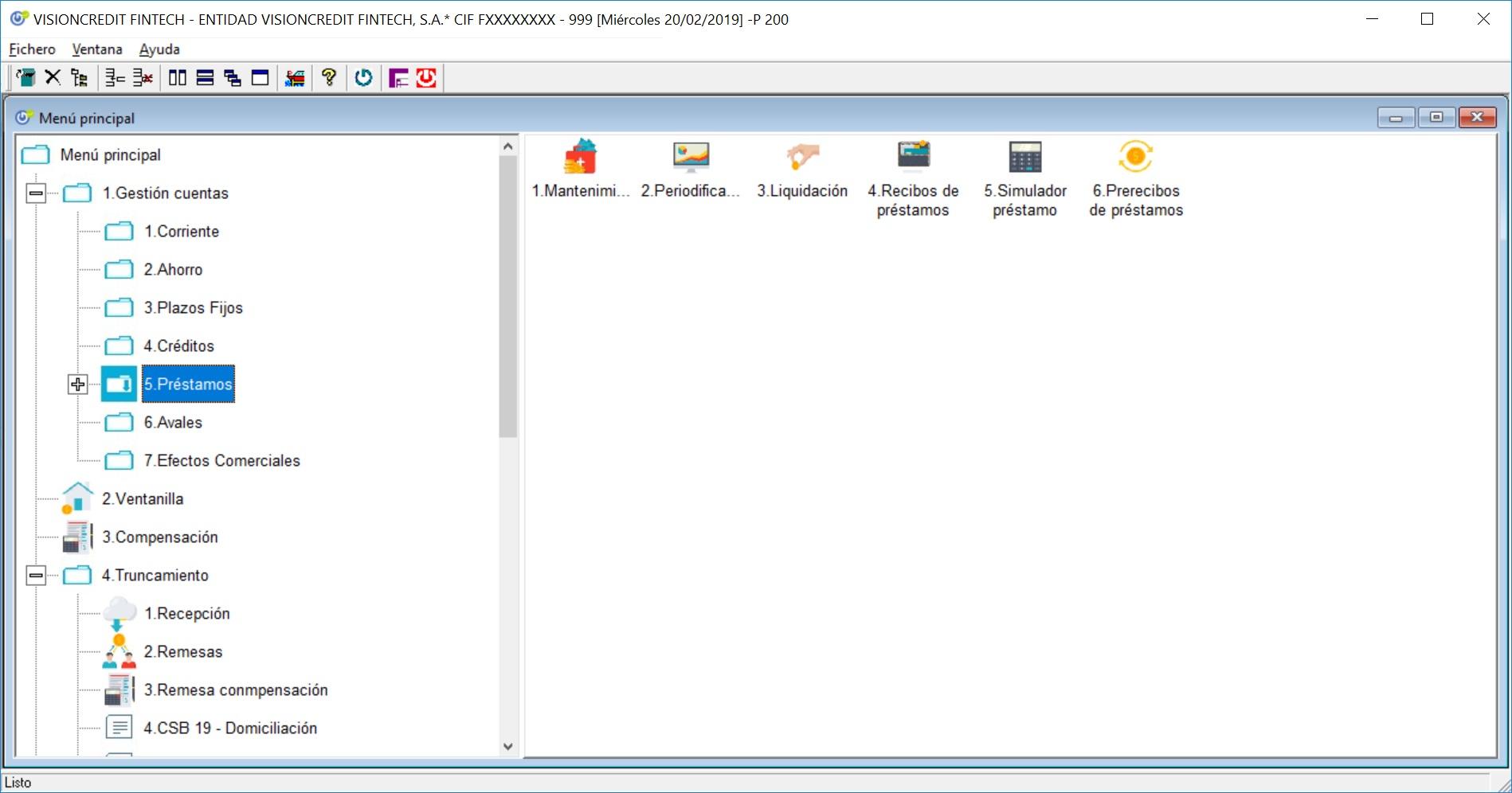

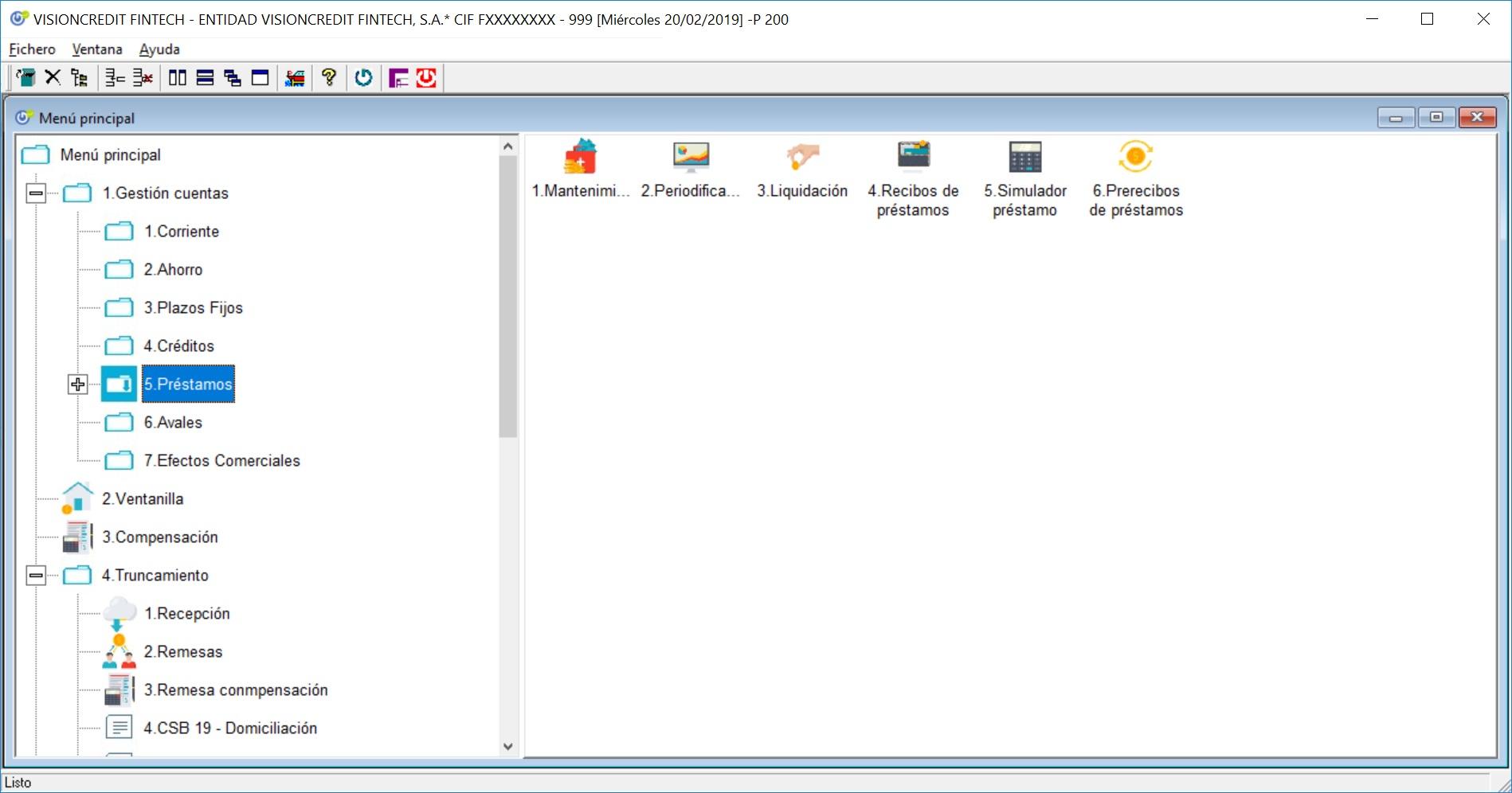

VisionCredit Fintech - Screenshot 1  VisionCredit Fintech - Screenshot 2

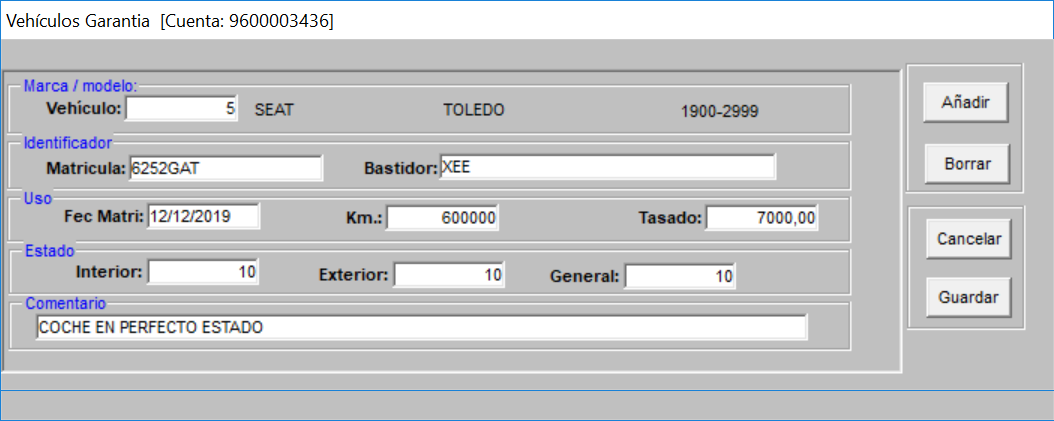

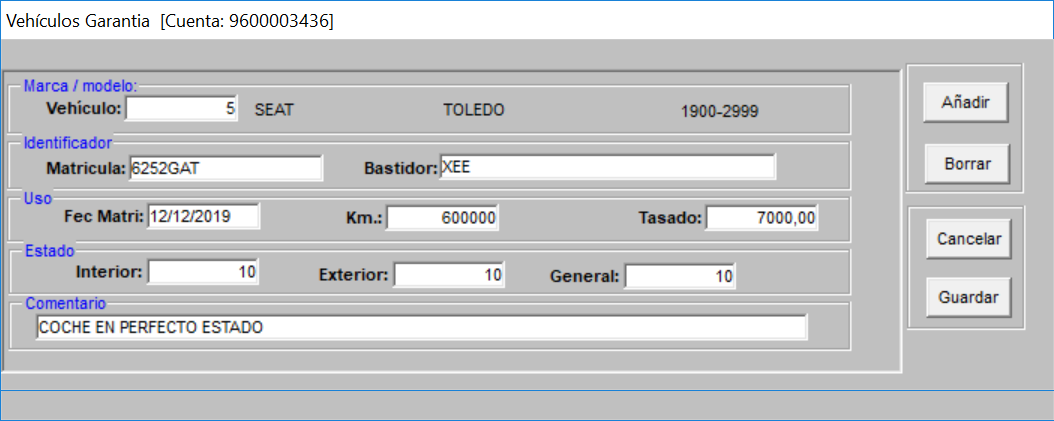

VisionCredit Fintech - Screenshot 2  VisionCredit Fintech - Screenshot 3

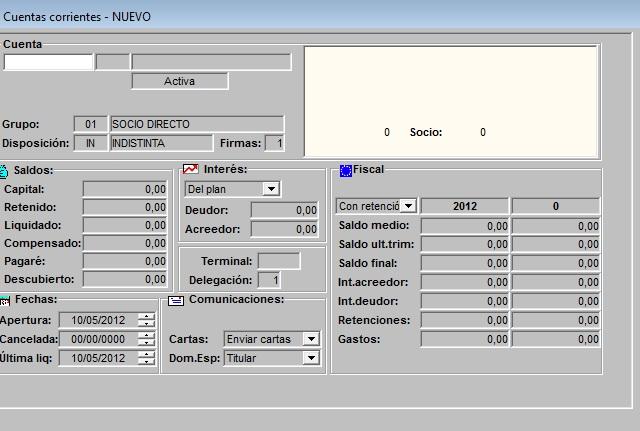

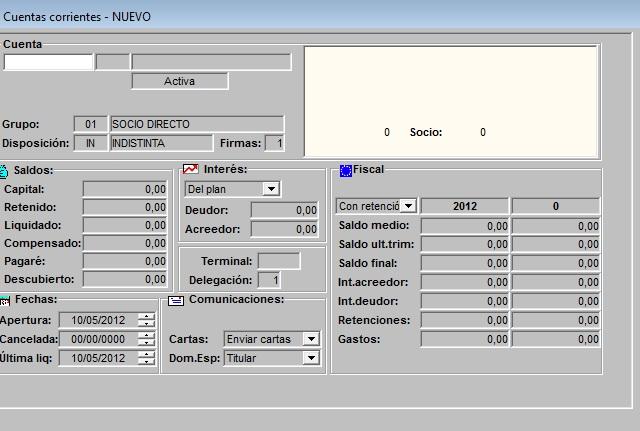

VisionCredit Fintech - Screenshot 3  VisionCredit Fintech - Screenshot 4

VisionCredit Fintech - Screenshot 4  VisionCredit Fintech - Screenshot 5

VisionCredit Fintech - Screenshot 5  VisionCredit Fintech - Screenshot 6

VisionCredit Fintech - Screenshot 6

VisionCredit Fintech: its rates

Gratuita

Free

Esential

$999.00

/user

Gold

Rate

On demand

Standard

Rate

On demand

Clients alternatives to VisionCredit Fintech

Optimize your financial processes with desktop publishing software. Save time and increase efficiency with Esker | S2P & O2C.

See more details See less details

Esker | S2P & O2C is desktop publishing software that makes it easy to manage your purchasing and sales processes. Thanks to its advanced features, you can automate repetitive tasks, reduce errors and improve the visibility of your financial operations.

Read our analysis about Esker | S2P & O2C

Streamline debt collection with automated tools, customizable workflows, and real-time reporting.

See more details See less details

Hoopiz Credit Management offers powerful features like customized payment plans, automated reminders, and integrated communication channels to help you collect debts efficiently. With real-time reporting, you can track progress and optimize your strategy to maximize recovery.

Read our analysis about Hoopiz Credit ManagementBenefits of Hoopiz Credit Management

Coverage of the entire sales-to-cash chain

Modular: Recovery, credit insurance,...

Ease of use and speed of installation

Streamline debt recovery with automated reminders, in-depth reporting, and customizable workflows to enhance efficiency and reduce outstanding payments.

See more details See less details

Billabex offers a comprehensive platform for managing debt collection that includes automated payment reminders, detailed reporting features for tracking performance, and customizable workflows tailored to unique business needs. These capabilities not only streamline the debt recovery process but also improve communication with clients, ultimately leading to faster resolution of outstanding payments and optimizing cash flow for organizations.

Read our analysis about BillabexBenefits of Billabex

Autonomy (works without manual intervention)

Integration with all billing software

Multilingual (Supports more than 80 languages)

Appvizer Community Reviews (0) The reviews left on Appvizer are verified by our team to ensure the authenticity of their submitters.

Write a review No reviews, be the first to submit yours.