lend.ezee : Launch Digital Loan Products 10× Faster with No-Code

lend.ezee: in summary

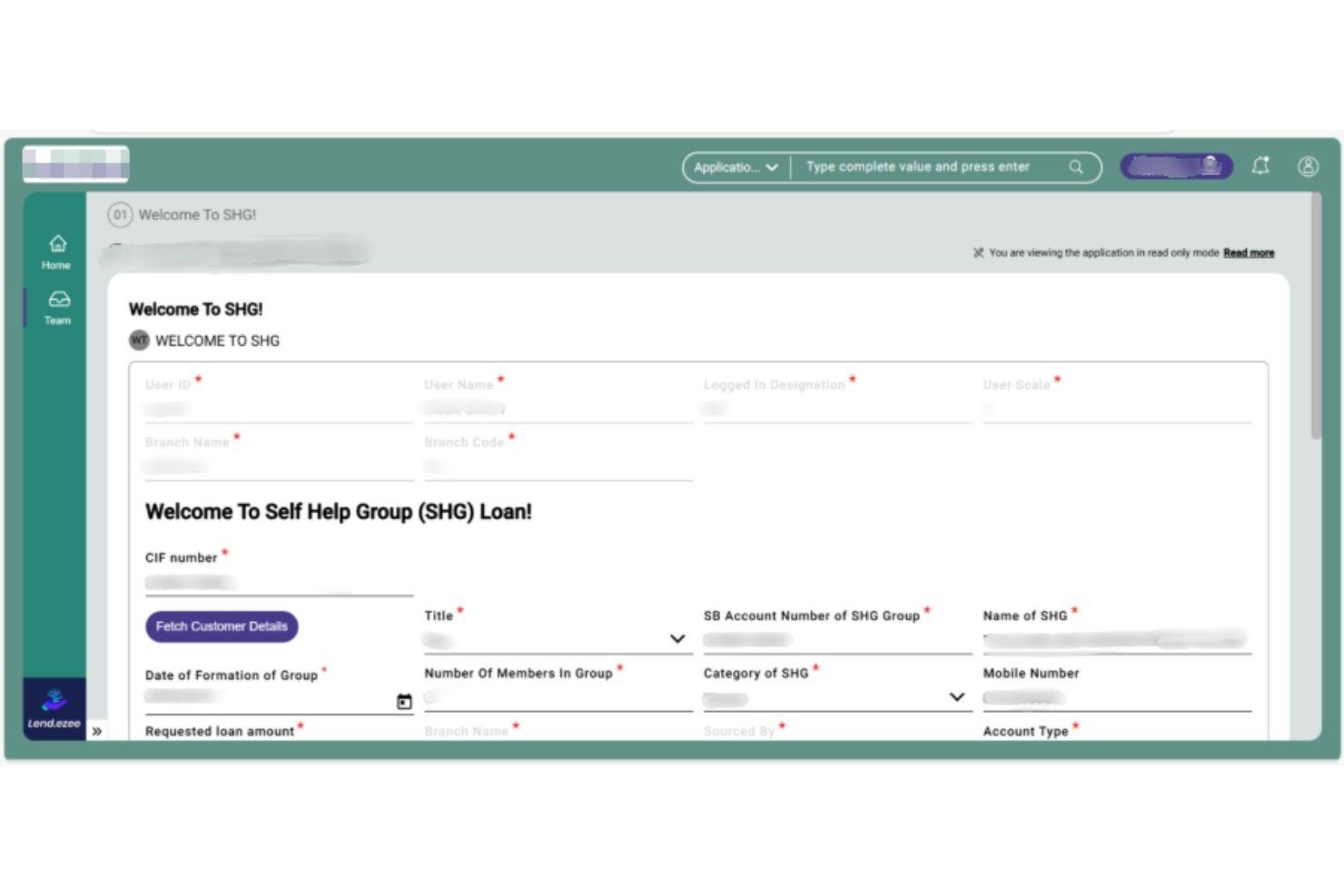

lend.ezee is an end-to-end digital lending launch platform designed for banks, NBFCs, fintechs, digital lenders, credit unions, and mutuals that want to accelerate loan product innovation without engineering bottlenecks. Built for Product, Risk, Compliance, Technology, and Operations teams, the platform enables institutions to create, test, and deploy digital loan journeys using a powerful no-code builder.

The platform digitizes the complete lending lifecycle from lead capture and onboarding to KYC/AML checks, document management, underwriting, approval, and disbursal. With its rule-driven credit engine, Lend.ezee automates risk assessment, improves accuracy, and reduces operational overhead. Real-time compliance guardrails ensure that every loan journey adheres to regulatory and internal policy requirements.

lend.ezee integrates seamlessly with core banking systems, LMS/LOS, KYC providers, credit bureaus, payment systems, and ecosystem partners, enabling lenders to modernize without disrupting existing infrastructure. Its advanced analytics dashboard provides actionable insights into funnel conversion, TAT, approval rates, drop-offs, and overall loan performance.

Whether for personal loans, MSME credit, gold loans, vehicle loans, or embedded lending partnerships, Lend.ezee empowers lenders to launch products rapidly, reduce operational costs, improve borrower experience, and scale digital lending with confidence.

Its benefits

Rapid No-Code Product Launch

End-to-End Digital Lending Automation

Compliance-First Architecture

Powerful Rule-Based Underwriting

Seamless Integrations with the Lending Ecosystem

ISO 9001, ISO 27001

lend.ezee: its rates

Standard

Rate

On demand

Clients alternatives to lend.ezee

Streamline loan origination process, from application to funding. Automate tasks, track progress, and integrate data.

See more details See less details

Loan Producer software simplifies loan origination by automating tasks such as data entry, document processing, and underwriting. You can track progress and collaborate with team members in real-time, reducing the time and effort required to process loans. The software also integrates with other systems to help streamline your workflow.

Read our analysis about Loan Producer

Automate loan origination with our software. Streamline processes, reduce errors, and improve customer experience.

See more details See less details

Seritus-CoS simplifies loan origination with its automation capabilities. It offers a seamless application process, integrates with various systems, and provides real-time data insights. Improve efficiency and customer satisfaction with Seritus-CoS.

Read our analysis about Seritus-CoS

Streamline loan origination with a powerful software that automates the process from start to finish.

See more details See less details

Eliminate manual errors and improve efficiency with Digital Back Office's intuitive interface, customizable workflows, and real-time reporting. Maximize ROI with a solution that scales with your business.

Read our analysis about Digital Back Office Appvizer Community Reviews (0) The reviews left on Appvizer are verified by our team to ensure the authenticity of their submitters.

Write a review No reviews, be the first to submit yours.