InsureEdge : Future-Ready Insurance Software

InsureEdge: in summary

InsureEdge is a configurable core insurance software platform developed by Damco Group. Designed for insurers, brokers, MGAs, and TPAs across personal, commercial, and specialty lines, the platform supports full lifecycle policy and claims management. It is particularly suited for mid-sized to large insurance carriers looking to digitize legacy processes, launch new insurance products, or streamline multi-line operations.

Built with a modular architecture, InsureEdge allows easy customization, faster product rollout, and integration with third-party services. Key benefits include reduced operational costs, improved process efficiency, and enhanced customer experience through automation and omnichannel support.

What are the key features of InsureEdge?

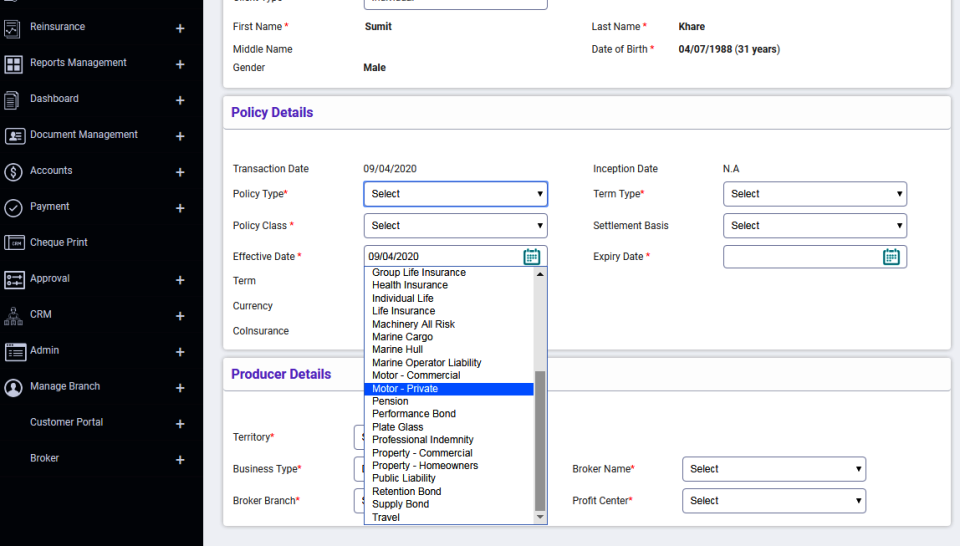

End-to-end policy lifecycle management

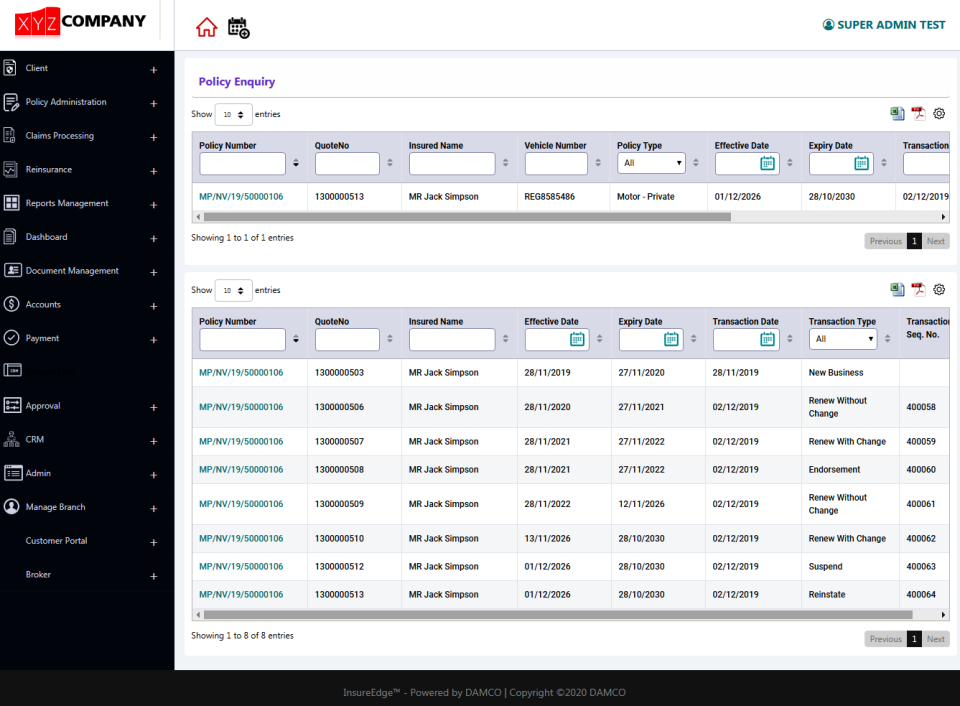

InsureEdge enables insurers to manage every phase of the policy lifecycle, from quote to renewal, using configurable workflows.

Create and manage quotes, proposals, and binders

Underwriting workflows with automated rule engines

Mid-term adjustments, endorsements, renewals, and cancellations

Document generation and digital storage

These capabilities help insurers reduce manual processes and ensure compliance with underwriting guidelines.

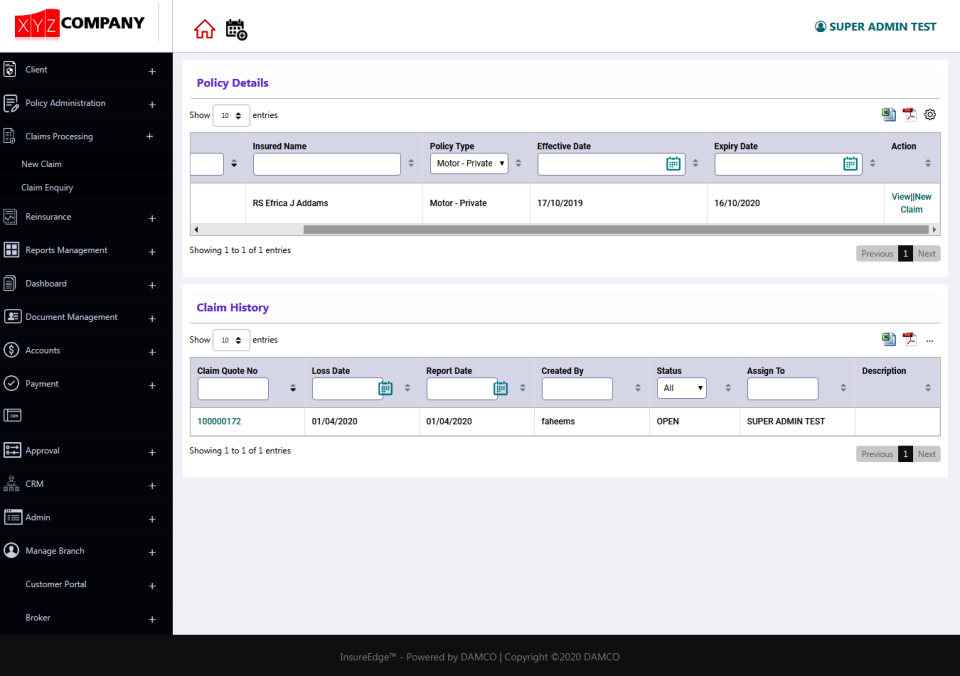

Integrated claims management system

The platform provides a full-featured claims module to handle FNOL (First Notice of Loss) through settlement.

Customizable claims intake workflows

Automated claims triaging and routing

Integration with adjusters, third-party assessors, and payment systems

Role-based access and audit trails for regulatory compliance

This helps reduce claims processing time and improves transparency for both adjusters and policyholders.

Support for multiple insurance lines

InsureEdge is preconfigured for general, life, health, and travel insurance, but its architecture allows quick adaptation to additional or specialized lines.

Manage multiple lines of business from a single platform

Easily launch new insurance products with minimal development

Prebuilt templates for common policy types

This supports insurers aiming to diversify offerings without needing multiple software platforms.

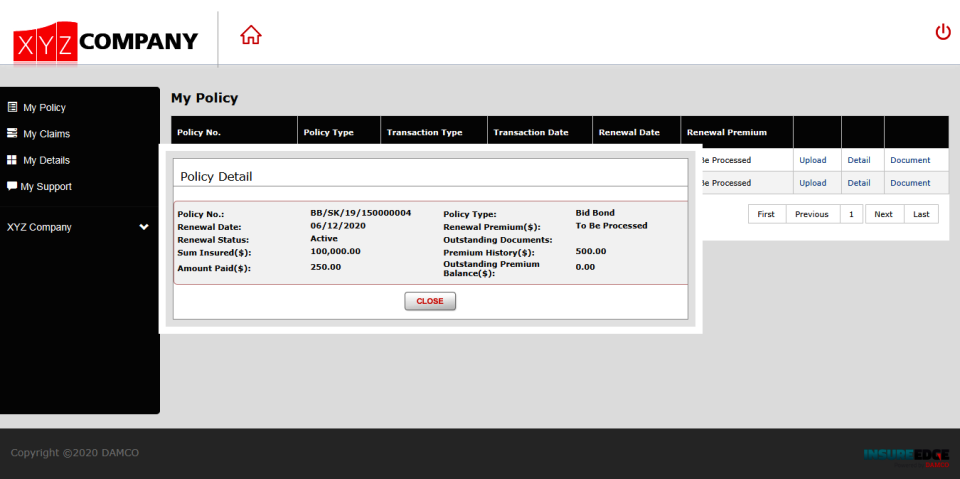

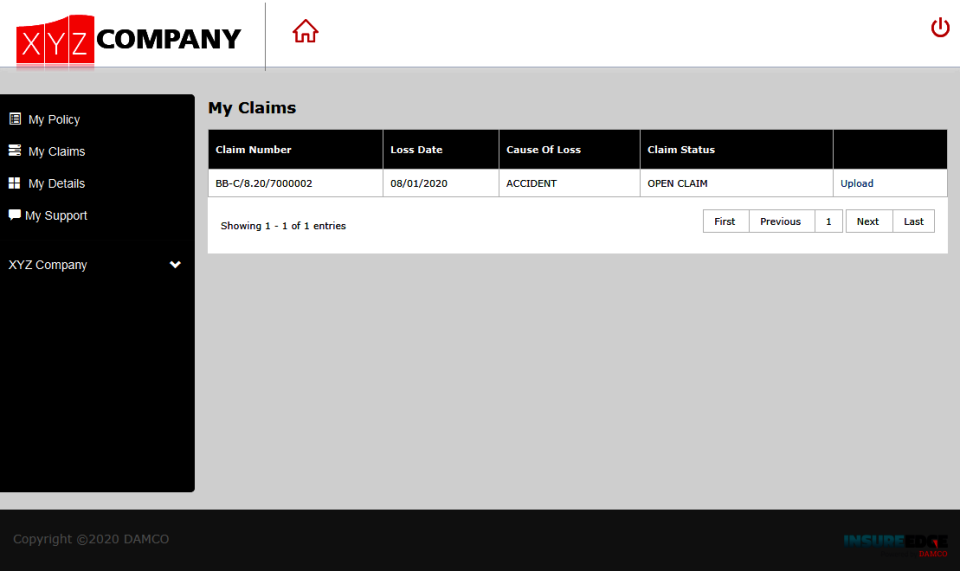

Customer and agent portal capabilities

The solution includes web-based portals for policyholders, agents, and brokers to facilitate digital engagement.

Self-service capabilities for quotes, renewals, and claims

Real-time updates on policy status and claims

Secure document upload and retrieval

Integrated chat and communication tools

This improves customer satisfaction by offering real-time, omnichannel interactions.

Business process automation and workflow engine

InsureEdge’s configurable workflow engine allows insurers to automate complex business processes.

Drag-and-drop interface to configure workflows

Rules-based decision making

SLA tracking and notification alerts

Integration with third-party services via APIs

This enhances internal efficiency and reduces operational overhead.

Analytics and reporting dashboard

The platform includes real-time dashboards and customizable reports for underwriting, claims, and financial metrics.

KPI monitoring for different departments

Claims ratio and loss trend analysis

Custom report generation for regulatory needs

Export options for further analysis

These insights help insurers make informed business decisions and meet reporting requirements.

Scalable, modular architecture with integration support

InsureEdge is built with scalability in mind and offers integration via REST APIs for external systems such as:

Payment gateways

CRM and ERP platforms

Document management systems

Underwriting and fraud detection services

Its modular design ensures new features can be added without system-wide disruptions.

To summarize

InsureEdge stands out as a robust core insurance platform that enables:

Full lifecycle management of policies and claims across multiple lines of business

Faster product launches with prebuilt templates and flexible configuration

Increased automation, reducing manual workloads and improving efficiency

Enhanced digital engagement through self-service portals for agents and customers

Scalability and interoperability, allowing integration with various third-party systems

By consolidating policy, claims, customer engagement, and workflow automation into one platform, InsureEdge supports insurers in modernizing their operations and driving digital transformation.

InsureEdge: its rates

standard

Rate

On demand

Clients alternatives to InsureEdge

Manage your customer relationships with ease. Track deals, set reminders, and access real-time insights with this CRM software.

See more details See less details

Stay on top of your sales pipeline with a visual interface that makes it easy to prioritize deals. Automate repetitive tasks and collaborate with your team to close more deals. Plus, integrate with your favorite tools for a seamless workflow.

Read our analysis about PipedriveBenefits of Pipedrive

Intuitive and easy-to-use user interface

93% satisfaction with our customer support

Over 500 app integrations

Streamline your insurance workflow with this SaaS software designed to simplify claims processing, policy management, and underwriting.

See more details See less details

Olino's intuitive interface and customizable features make it easy to manage all aspects of your insurance business. With automated workflows, real-time data analytics, and seamless integrations, you can save time and improve efficiency. Plus, advanced security measures ensure your data is always protected.

Read our analysis about Olino

Streamline insurance management with our software. Automate tasks, manage policies, and track claims with ease.

See more details See less details

Insly's insurance software simplifies your workload. Set up automatic notifications for policy renewals and claims, and access all data in one place. Save time and increase efficiency.

Read our analysis about Insly Appvizer Community Reviews (0) The reviews left on Appvizer are verified by our team to ensure the authenticity of their submitters.

Write a review No reviews, be the first to submit yours.