Openkoda : Insurance Innovations Built Faster

Openkoda: in summary

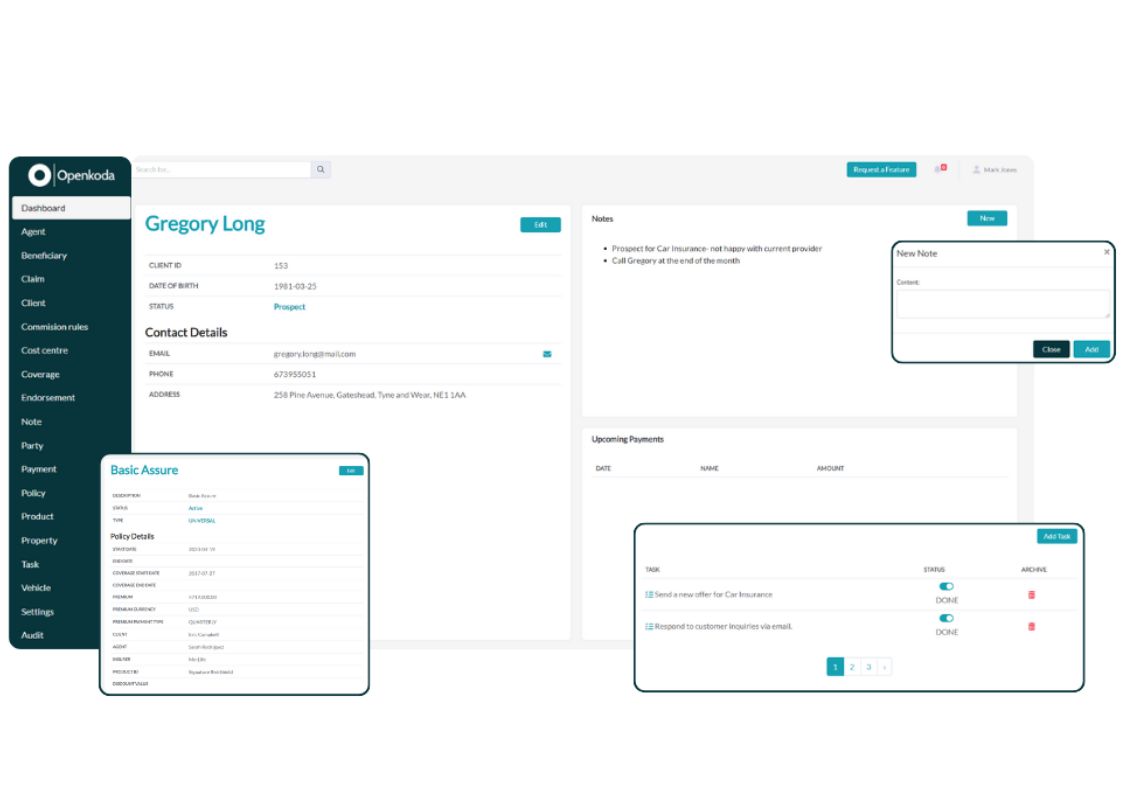

Openkoda is an open-source insurtech platform designed to accelerate the development of insurance software applications. Tailored for insurers, MGAs, and insurtech startups, it serves both enterprise-grade companies modernizing legacy systems and agile teams launching new digital insurance products. Openkoda offers a modular architecture, prebuilt templates, and configurable components that reduce the time, cost, and complexity of software delivery.

Key benefits include:

Rapid development using customizable templates for claims, policies, and embedded insurance.

Full code ownership, ensuring long-term control and flexibility.

Unlimited users and transparent pricing with no scaling penalties.

What are the key features of Openkoda?

Modular foundation for fast insurance software development

Openkoda provides production-ready templates for building or modernizing core insurance applications. These templates cover:

Claims management

Policy administration

Embedded insurance offerings

Instead of starting from scratch, development teams begin with prebuilt business logic and UI components. Each module is customizable, enabling faster prototyping and go-to-market speed without compromising flexibility.

Prebuilt, extendable feature modules

Openkoda includes a library of plug-and-play features that can be integrated as needed. These features can be extended or modified through the open-source codebase:

Reporting AI for data-driven insights

Embeddable forms to gather customer input

Underwriter dashboards and client portals

Document generation with data-driven automation

Role-based access control for internal permissions

Unlimited user management

CMS and document management

Each module is designed for adaptability, allowing insurers to tailor workflows and interfaces without vendor restrictions.

Open APIs and integration capabilities

Openkoda is API-first, providing seamless integration with third-party systems commonly used in insurance workflows. Supported technologies include:

REST/GraphQL APIs for flexible connectivity

Event-driven architecture for automation

Webhooks and authentication tools to align with enterprise standards

Integration with external services like CRMs, payment gateways, or underwriting platforms

This enables insurers to embed insurance products into digital customer journeys or connect with existing infrastructure for modernization projects.

Insurance automation and workflow tools

To streamline back-office and front-end operations, Openkoda offers:

Workflow engines and rule-based automation

Visual dashboard builders for custom interfaces

Customizable logic and UI through code-based extensions

These tools enable automation of decision-making processes, such as quote generation, policy issuance, or claims handling, reducing manual effort and operational delays.

Legacy system modernization capabilities

For companies with outdated systems, Openkoda offers a clear upgrade path:

Migrate existing workflows into a modern architecture

Replatform key modules like claims or policy without full reengineering

Use prebuilt templates to preserve business logic while enabling scalability

This approach minimizes disruption and accelerates digital transformation, often without requiring a full system replacement.

Open-source and vendor-agnostic design

A standout aspect of Openkoda is its open-source codebase and commitment to no vendor lock-in. Clients:

Own and control their source code

Deploy on their own infrastructure

Avoid user-based pricing restrictions

Extend and export functionality at any time

This flexibility empowers insurers to maintain long-term autonomy over their technology stack, a rare proposition in the insurtech space.

To summarize

Openkoda stands out in the insurtech market for its:

Rapid development capabilities, reducing time to market with prebuilt templates and features

Full flexibility, letting insurers build, extend, and modify every aspect of their application

Open-source ownership, eliminating vendor lock-in and allowing full code control

Scalable architecture, suitable for startups and enterprise insurers alike

Transparent pricing, with unlimited users and no hidden fees

By combining ready-to-use components with full customizability, Openkoda offers a unique balance of speed, control, and future scalability for insurance organizations building modern digital systems.

Its benefits

Customizability

Open-source tech stack

Freedom to deploy on-prem

Multitenancy

No vendor lock-in

Openkoda: its rates

standard

Rate

On demand

Clients alternatives to Openkoda

Manage your customer relationships with ease. Track deals, set reminders, and access real-time insights with this CRM software.

See more details See less details

Stay on top of your sales pipeline with a visual interface that makes it easy to prioritize deals. Automate repetitive tasks and collaborate with your team to close more deals. Plus, integrate with your favorite tools for a seamless workflow.

Read our analysis about PipedriveBenefits of Pipedrive

Intuitive and easy-to-use user interface

93% satisfaction with our customer support

Over 500 app integrations

Streamline your insurance workflow with this SaaS software designed to simplify claims processing, policy management, and underwriting.

See more details See less details

Olino's intuitive interface and customizable features make it easy to manage all aspects of your insurance business. With automated workflows, real-time data analytics, and seamless integrations, you can save time and improve efficiency. Plus, advanced security measures ensure your data is always protected.

Read our analysis about Olino

Streamline insurance management with our software. Automate tasks, manage policies, and track claims with ease.

See more details See less details

Insly's insurance software simplifies your workload. Set up automatic notifications for policy renewals and claims, and access all data in one place. Save time and increase efficiency.

Read our analysis about Insly Appvizer Community Reviews (0) The reviews left on Appvizer are verified by our team to ensure the authenticity of their submitters.

Write a review No reviews, be the first to submit yours.