Paychex : Streamlined Payroll for SMBs and Enterprises

Paychex: in summary

Paychex Payroll is a cloud-based payroll processing solution designed for small to large businesses across a variety of industries. It automates payroll tasks, supports tax compliance, and integrates with a suite of HR and benefits services. Known for its flexibility and service options, Paychex stands out by offering multiple levels of payroll support—from self-service tools for small teams to fully managed services for complex enterprise needs.

Ideal for business owners, HR professionals, and finance teams, Paychex Payroll supports organizations with diverse pay schedules, multi-state operations, and evolving compliance requirements. Key benefits include automatic tax filing, employee self-service access, and optional integration with retirement and insurance plans through Paychex’s broader ecosystem.

What are the key features of Paychex Payroll?

Automated payroll processing across employee types

Paychex automates the full payroll lifecycle, making it easier to manage salaried, hourly, contract, and freelance workers. The platform calculates wages, deductions, and reimbursements accurately, even across states and varying pay schedules.

- Supports direct deposit, paper checks, and pay cards

- Handles garnishments and tip reporting

- Allows custom earnings and deduction codes

Integrated payroll tax management

One of Paychex Payroll’s core strengths is its automated tax calculation and filing service. It manages federal, state, and local payroll taxes on behalf of the business, helping reduce compliance risk.æ

- Automatically calculates, withholds, and files taxes

- Year-end processing includes W-2s and 1099s

- Provides real-time tax liability reports and historical records

Employee and contractor self-service

Employees can access their payroll information through the Paychex Flex platform, reducing administrative burden on HR teams.

- View pay stubs, W-2s, and tax forms online

- Update personal and direct deposit information

- Access on desktop or mobile app

Customizable payroll and HR integrations

Paychex Payroll integrates with time and attendance systems, accounting platforms, and benefits management tools—many within the Paychex ecosystem, but also third-party solutions.

- Syncs with QuickBooks®, Xero™, and other accounting software

- Seamless integration with Paychex Time and Paychex HR services

- Open API for custom integrations

Scalable service levels with optional expert support

Users can choose self-service, managed, or fully outsourced payroll service levels depending on their internal capabilities. Dedicated payroll specialists are available for setup, ongoing support, and regulatory guidance.

- Choice of service packages based on business complexity

- Dedicated payroll specialist for higher-tier plans

- Onboarding assistance and support during regulatory changes

To summarize

- Reduces payroll errors with automated calculations and tax filings

- Saves time through integrations and employee self-service tools

- Supports business growth with flexible plans and add-on services

- Improves compliance by managing tax submissions across jurisdictions

- Provides scalable support with access to payroll experts when needed

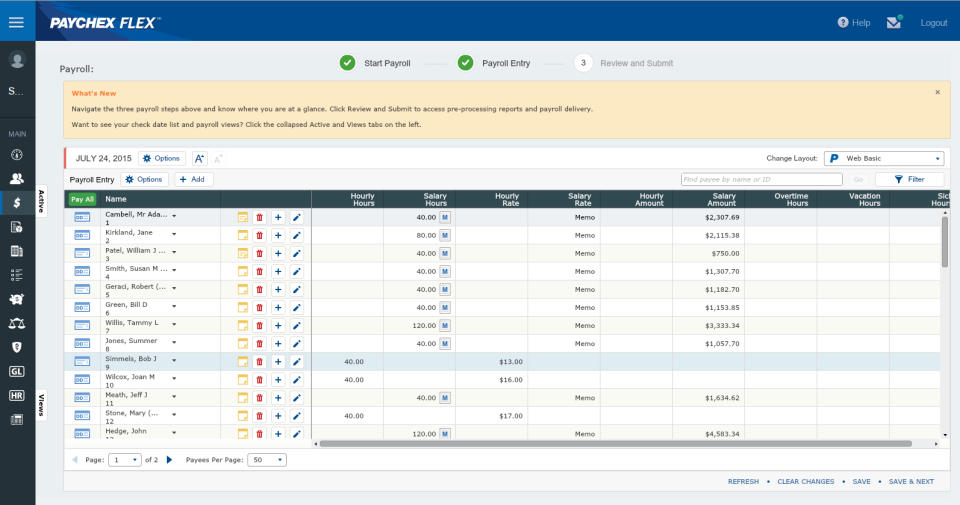

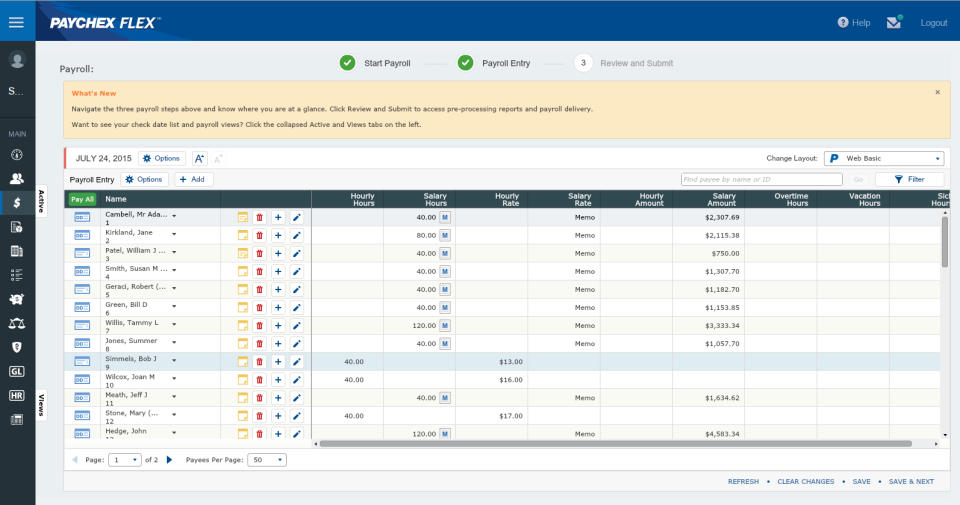

Paychex - Paychex Flex-screenshot-0

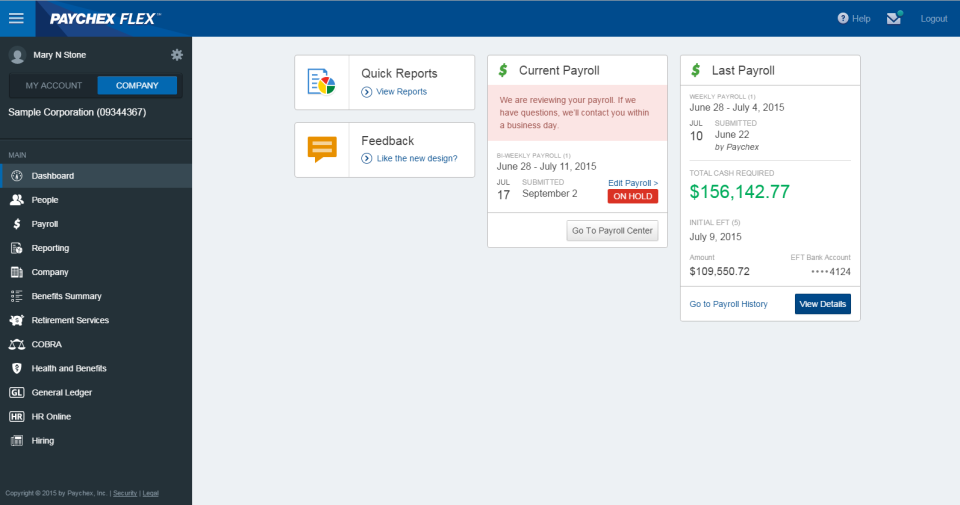

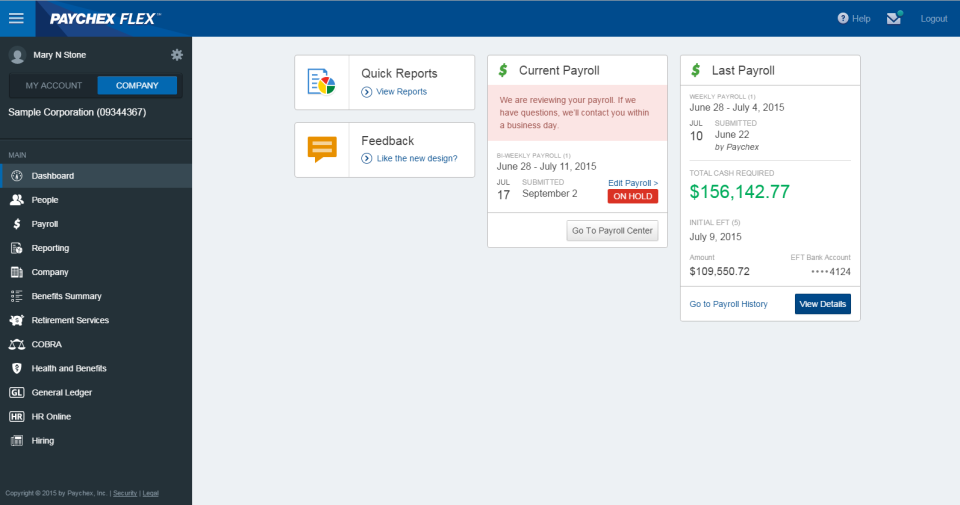

Paychex - Paychex Flex-screenshot-0  Paychex - Paychex Flex-screenshot-1

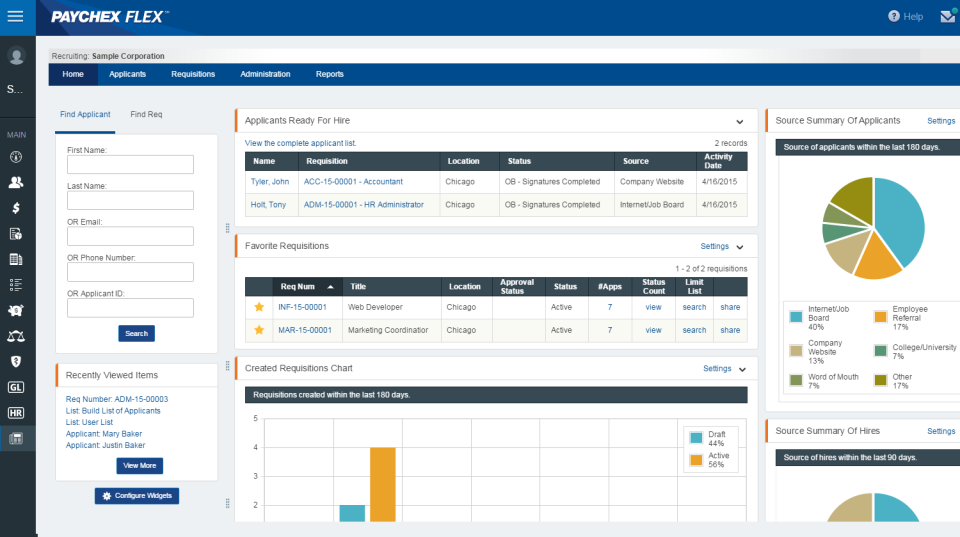

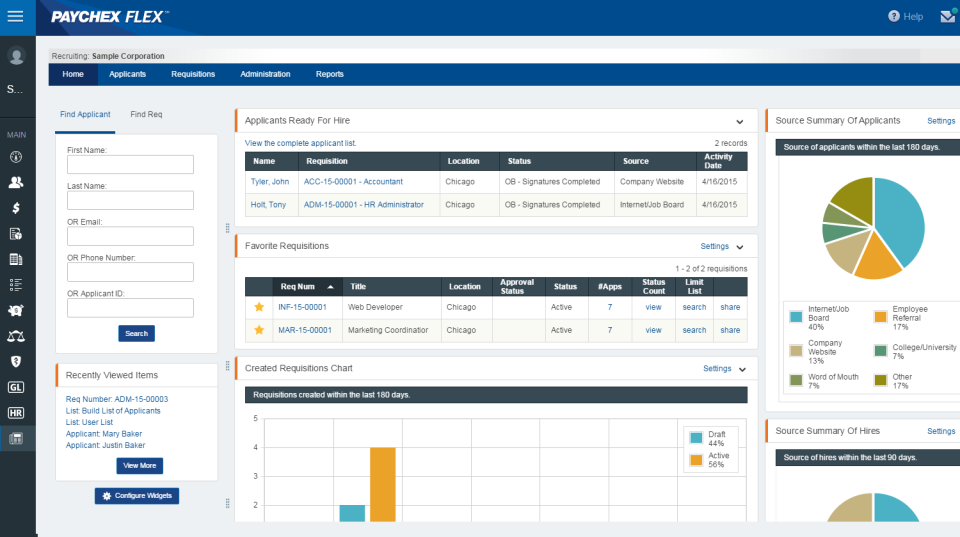

Paychex - Paychex Flex-screenshot-1  Paychex - Paychex Flex-screenshot-2

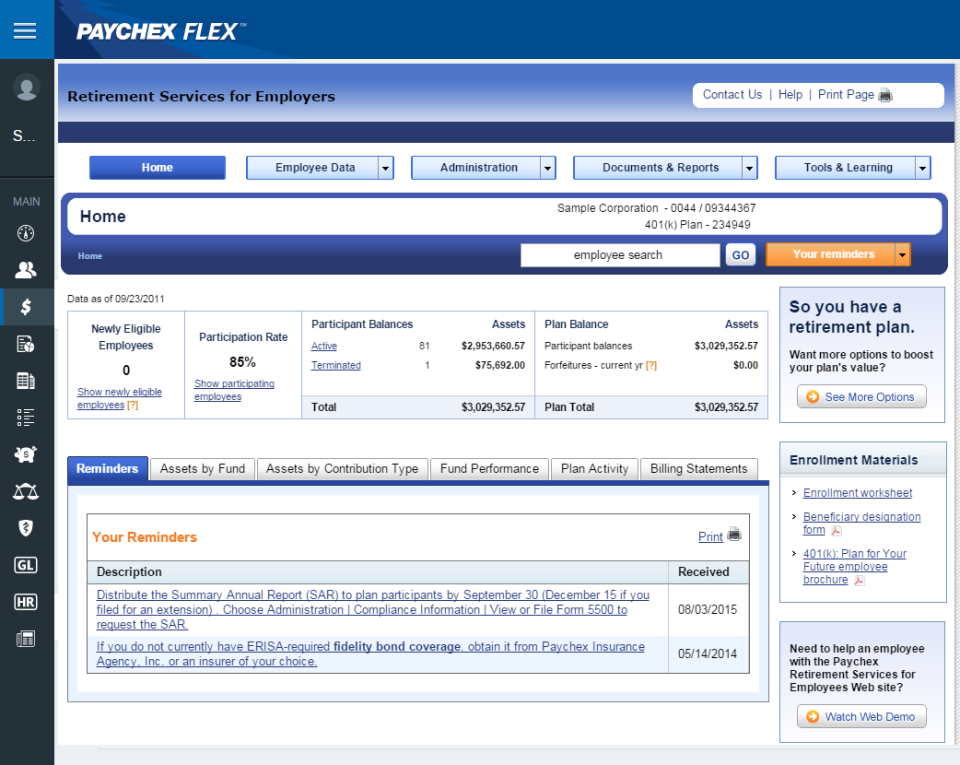

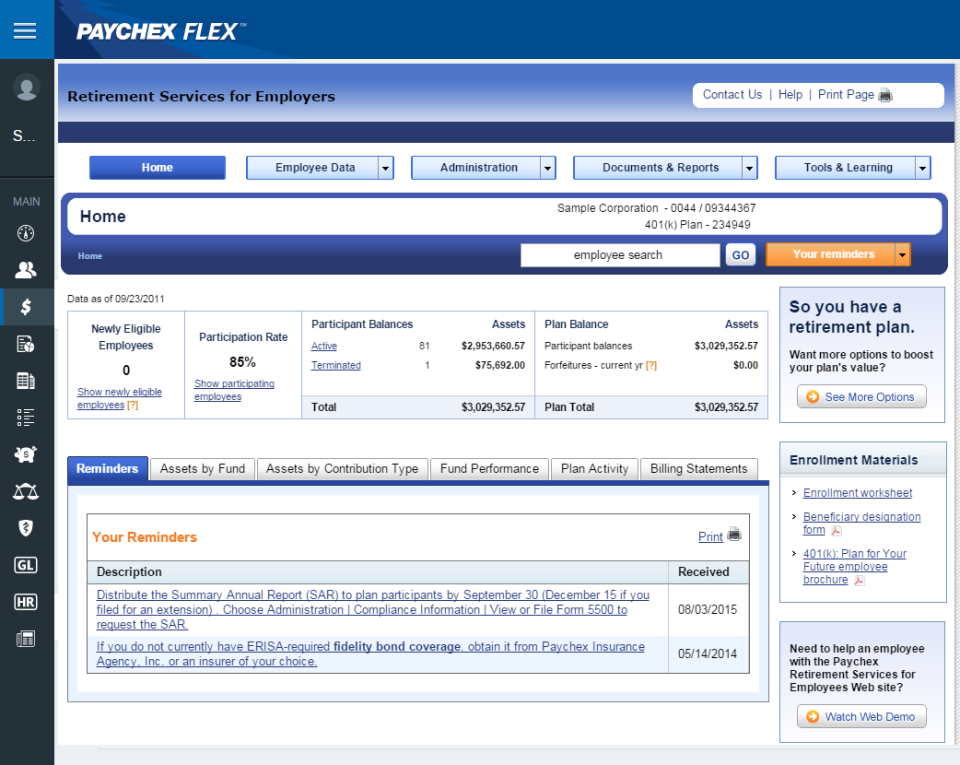

Paychex - Paychex Flex-screenshot-2  Paychex - Paychex Flex-screenshot-3

Paychex - Paychex Flex-screenshot-3

Paychex: its rates

standard

Rate

On demand

Clients alternatives to Paychex

Streamline employee scheduling and time tracking with this Planning software. Easily manage shifts, leave requests, and payroll.

See more details See less details

With this software, employers can create schedules with just a few clicks, while employees can access their schedules and request time off from their mobile devices. The software also allows for seamless integration with payroll systems for accurate and efficient payment processing.

Read our analysis about SkelloBenefits of Skello

Complete solution from scheduling to payroll

Quick and intuitive to use

Online support with response time of less than 3 minutes

Streamlines HR tasks, improves talent management, and enhances workforce analytics.

See more details See less details

Atlas HXM revolutionizes the HR process by offering a comprehensive solution for talent management, employee engagement, and analytics. It automates routine tasks, thereby giving HR teams more time to focus on strategic initiatives. Advanced data analytics provide deep insights into workforce trends, helping organizations make informed decisions.

Read our analysis about Atlas HXMBenefits of Atlas HXM

Significant cost savings compared to setting up/maintaining an entity

International compliance and total adherence to local regulations

International benefits administration

Streamline HR processes with automated onboarding, payroll management, employee benefits, and compliance tracking to enhance workforce efficiency.

See more details See less details

Rippling offers a comprehensive solution for global HR management by integrating essential functions such as automated onboarding, payroll processing, benefits administration, and compliance monitoring. It enables organizations to manage their workforce seamlessly across multiple countries with customizable workflows. This software simplifies tedious HR tasks, allowing teams to focus on strategic initiatives while ensuring compliance and providing employees with the tools they need for an optimal work experience.

Read our analysis about Rippling Appvizer Community Reviews (0) The reviews left on Appvizer are verified by our team to ensure the authenticity of their submitters.

Write a review No reviews, be the first to submit yours.